Selling a House in West Virginia: 8 Simple Steps for Homeowners

Selling a House in West Virginia: 8 Simple Steps for Homeowners

Updated January 2026 · 18 min read

Selling your home in West Virginia involves a process that's distinct from other states—from navigating the Mountain State's unique disclosure rules to understanding attorney requirements at closing. Whether you own property in Charleston, Morgantown, the Eastern Panhandle, or a quiet town in the Appalachian hills, this guide walks you through every step from preparing your home to handing over the keys.

West Virginia's housing market continues to show steady activity in 2026, with the median home price hovering around $243,000 statewide and properties spending approximately 59 to 63 days on market before going under contract. For sellers who understand the process and price their homes strategically, opportunities abound.

Quick Answer

To sell a house in West Virginia, you'll need to prepare your home, price it accurately using local market data, hire a real estate agent or list FSBO, market the property, negotiate offers, complete required disclosures, and close with an attorney (required by state law). The typical timeline is 60 to 90 days from listing to closing, and sellers pay approximately 8% to 10% of the sale price in total costs including commissions.

Key Takeaways

- Attorney required: West Virginia law mandates an attorney be present at closing, typically costing $750 to $1,250.

- Caveat emptor state: WV doesn't require a formal disclosure form, but fraud is prohibited—disclose known issues proactively.

- Transfer tax: Sellers typically pay $1.10 per $500 of the sale price (approximately 0.22%).

- Commission rates: Average total commission is 5.65%, though reduced-fee options exist.

- Timeline: Expect 45 to 75 days on market plus 30 to 45 days to close.

- Regional variations: Home values and days on market vary significantly between Charleston, Morgantown, and rural areas.

Table of Contents

- Prepare Your Home for Sale

- Price Your Home Accurately

- Choose How to Sell

- List and Market Your Property

- Manage Showings and Open Houses

- Review Offers and Negotiate

- Navigate Inspections and Appraisals

- Close the Sale

- West Virginia Seller Closing Costs

- WV Disclosure Requirements

- Selling Timeline

- Common Mistakes to Avoid

- Alternatives to Traditional Selling

- FAQs

West Virginia Housing Market Snapshot – January 2026

$242,900

Median Sale Price

62

Median Days on Market

+3.9%

YoY Price Change

96.3%

Sale-to-List Ratio

Source: Redfin, December 2025

The Mountain State offers a unique real estate environment. Home prices remain well below the national median, making West Virginia one of the most affordable states in which to buy property. For sellers, this means understanding buyer expectations and pricing competitively within your local market.

Step 1: Prepare Your Home for Sale

First impressions drive sales. In West Virginia's market, where buyers often prioritize value and condition, a well-prepared home can significantly impact your final sale price and days on market.

Curb Appeal Essentials

West Virginia's natural beauty sets a high bar for first impressions. Buyers expect homes that complement the surrounding landscape rather than clash with it. Focus on these high-impact exterior improvements:

- Landscaping: Mow the lawn, trim shrubs, and plant native flowers like rhododendrons or mountain laurels that thrive in WV's climate

- Exterior cleaning: Pressure wash the driveway, siding, and walkways to remove mountain mildew and grime

- Front entry: Repaint the front door, replace worn hardware, and add a new welcome mat

- Roof and gutters: Clean gutters and address any visible roof issues—WV's wet climate makes these critical

Home Preparation Checklist

| ☐ | Deep clean entire home including carpets, windows, and appliances |

| ☐ | Declutter and remove personal items (family photos, collections) |

| ☐ | Depersonalize spaces to help buyers envision themselves in the home |

| ☐ | Make minor repairs: fix leaky faucets, squeaky doors, cracked tiles |

| ☐ | Neutralize paint colors in rooms with bold or dated choices |

| ☐ | Service HVAC and get documentation (important in WV's variable climate) |

| ☐ | Test well and septic if applicable—have records ready |

| ☐ | Gather documents: surveys, permits, utility bills, maintenance records |

Pre-Listing Inspection: Worth It?

A pre-listing home inspection costs $300 to $500 in West Virginia but can provide significant benefits. You'll discover issues before buyers do, have time to make repairs on your terms, and demonstrate transparency that builds buyer confidence. This is particularly valuable for older homes, which are common throughout the state.

For homes with well and septic systems—prevalent in rural West Virginia—consider getting these systems inspected and certified before listing. Documentation of a compliant septic system and clean water test removes a common source of deal delays.

Step 2: Price Your Home Accurately

Pricing strategy makes or breaks a home sale. Overpriced homes linger on the market, eventually selling for less than they would have at a competitive initial price. Underpriced homes leave money on the table. In West Virginia, where markets vary dramatically by region, local pricing expertise is essential.

| WV Region | Median Price | Avg. Days on Market | YoY Growth |

|---|---|---|---|

| Charleston Metro | $162,000 – $225,000 | 55 – 65 days | +4.0% |

| Morgantown | $267,000 | 40 – 55 days | +8.1% |

| Eastern Panhandle | $245,000 – $528,000 | 35 – 50 days | +9.3% |

| Huntington-Ashland | $157,000 | 60 – 75 days | +4.8% |

| Rural/Southern WV | $85,000 – $150,000 | 75 – 120 days | +2.5% |

How to Determine Your Home's Value

Multiple data points create the most accurate picture:

Comparative Market Analysis (CMA): A licensed real estate agent analyzes recently sold homes similar to yours in location, size, condition, and features. This is typically the most reliable pricing method.

Online Valuation Tools: Automated estimates from real estate websites provide a starting point but often miss local nuances. In West Virginia's varied terrain, these tools may not account for factors like mountain views, flood zones, or mine subsidence areas.

Professional Appraisal: Hiring an appraiser costs $300 to $500 but provides an independent valuation useful for estate sales, divorces, or when you want objective data before setting a price.

What's Your West Virginia Home Worth?

Get a data-driven estimate of your home's current market value—no obligation required.

Get My Free Home Valuation →Pricing Psychology That Works

Strategic pricing attracts more buyers and can spark competition:

- Price just below round numbers: $249,900 captures searches up to $250K while appearing more affordable than $250,000

- Account for current inventory: In areas with limited competition, you may have more pricing flexibility

- Consider absorption rate: If homes in your price range are selling in under 30 days, the market supports stronger pricing

- Build in negotiation room: Most WV sellers receive 96-99% of asking price, so price accordingly

Step 3: Choose How to Sell

West Virginia sellers have several paths to sale, each with distinct trade-offs between cost, convenience, and control.

| Selling Method | Typical Cost | Time to Sell | Best For |

|---|---|---|---|

| Full-Service Agent | 5-6% commission | 60-90 days | Most sellers; maximum exposure and support |

| Reduced-Fee Agent | 1.5-3% + buyer agent | 60-90 days | Cost-conscious sellers wanting professional help |

| Flat Fee MLS | $200-$500 + buyer agent | Varies widely | Experienced sellers comfortable managing process |

| FSBO (No MLS) | 0% (if no buyer agent) | Often longer | Sellers with ready buyer or strong networks |

| Cash Buyer/Investor | 10-30% below market | 7-14 days | Urgent sales, as-is condition, distressed properties |

Working With a Real Estate Agent

The average real estate commission in West Virginia is 5.65%, which includes both the listing agent (approximately 2.83%) and the buyer's agent (approximately 2.82%). On a $243,000 home, this totals roughly $13,700.

A skilled agent provides significant value: accurate pricing based on local knowledge, professional marketing and photography, negotiation expertise, transaction management, and guidance through West Virginia's unique closing requirements. For most sellers, the trade-off between commission and convenience favors professional representation.

✓ Hiring an Agent – Pros

- Access to MLS and broader buyer pool

- Professional marketing and photography

- Negotiation expertise

- Transaction management and paperwork

- Local market knowledge

✗ Hiring an Agent – Cons

- Commission costs reduce net proceeds

- Less control over showing schedule

- Quality varies—interview multiple agents

- Listing contracts typically lock in 3-6 months

- May not align with your urgency

Some agents offer reduced listing fees without sacrificing service quality. A 1.5% listing fee structure, for example, can save thousands while still providing full-service representation including professional marketing, expert negotiation, and complete transaction support.

Sell Your Home for a 1.5% Listing Fee

Full-service representation—including marketing, negotiation, and transaction support—at a fraction of traditional commission rates. See how much you could save.

Learn About Our 1.5% Program →Step 4: List and Market Your Property

Effective marketing exposes your home to qualified buyers and generates competitive interest. In West Virginia's diverse market, tailored strategies work better than one-size-fits-all approaches.

Essential Marketing Elements

Professional Photography: Quality photos are non-negotiable. Homes with professional images sell faster and for more money. In West Virginia, where many homes feature scenic views, capturing this appeal photographically is especially valuable. Expect to pay $150 to $350 for professional real estate photography.

MLS Listing: The Multiple Listing Service syndicates your property to Zillow, Realtor.com, Redfin, and hundreds of other sites. This is the primary way agents find homes for their buyers. If selling FSBO, consider a flat-fee MLS service to gain this exposure.

Compelling Listing Description: Highlight features that matter to West Virginia buyers: energy-efficient systems (heating costs matter in mountain winters), updated mechanicals, outdoor spaces, views, and proximity to amenities.

Marketing Must-Haves

| ☐ | 20+ professional photos including all rooms, exterior, and key features |

| ☐ | Detailed MLS listing with accurate square footage, room count, and features |

| ☐ | Virtual tour or video walkthrough for out-of-area buyers |

| ☐ | Yard sign with contact information and/or QR code |

| ☐ | Social media promotion on Facebook, Instagram, and local groups |

| ☐ | Property flyer/brochure with photos, features, and contact info |

When to List in West Virginia

Spring (April through June) typically sees the highest buyer activity in West Virginia, as families aim to move during summer break and before the next school year. However, listing during off-peak seasons can work to your advantage if inventory is low—less competition means more attention on your property.

Step 5: Manage Showings and Open Houses

Every showing is an opportunity to sell. Making your home accessible and appealing during viewings maximizes your chances of receiving strong offers.

Showing Best Practices

- Be flexible with scheduling: Accommodate evening and weekend requests when possible—buyers often work during the day

- Leave during showings: Buyers feel more comfortable exploring and discussing the home without the seller present

- Secure valuables and medications: Keep these out of sight during showings

- Maintain cleanliness: Quick tidy-ups before each showing make a significant difference

- Control pets: Remove or contain pets during viewings to avoid distractions and accommodate allergies

Open House Strategy

Open houses generate multiple visits in a concentrated timeframe, creating urgency and allowing neighbors to spread word-of-mouth. Schedule your first open house for the weekend after listing goes live, when interest peaks. Provide refreshments, property information sheets, and have your agent ready to answer questions.

Step 6: Review Offers and Negotiate

Receiving an offer starts the negotiation phase. Understanding what makes a strong offer—beyond just price—helps you make informed decisions.

Evaluating Offers: Beyond Price

| Offer Component | What to Consider |

|---|---|

| Offer Price | How it compares to asking price and recent comps; room for negotiation |

| Earnest Money Deposit | Larger deposits (2-3% of price) signal serious buyers; typical in WV is 1-2% |

| Financing Type | Cash offers close faster; conventional loans smoother than FHA/VA for older homes |

| Pre-Approval Status | Pre-approved buyers verified by lender; pre-qualified is less certain |

| Contingencies | Inspection, financing, appraisal, sale-of-home; fewer = stronger offer |

| Closing Timeline | 30-45 days typical; faster or flexible timelines may match your needs |

| Seller Concessions | Requests for closing cost credits reduce your net proceeds |

Negotiation Strategies

In West Virginia's balanced market, successful negotiation involves understanding buyer motivations and finding mutually beneficial solutions:

- Counter strategically: Rather than splitting the difference, counter based on your priorities (price, timeline, repairs)

- Consider the whole package: A lower offer with no contingencies may net more than a higher offer that falls through

- Use inspection results wisely: Credit at closing is often preferable to making repairs yourself

- Set deadlines: Offer response deadlines create urgency and prevent indefinite negotiation

Know Your Bottom Line Before Negotiating

Use our free Seller Net Sheet calculator to understand exactly what you'll walk away with after commissions, closing costs, and payoffs.

Calculate My Net Proceeds →Step 7: Navigate Inspections and Appraisals

Once you accept an offer, the contingency period begins. This is when buyers conduct due diligence that can lead to renegotiation or, occasionally, a failed transaction.

Home Inspection Process

Most buyers in West Virginia will order a professional home inspection, costing them $300 to $500. The inspector examines the home's major systems: structure, roof, HVAC, plumbing, electrical, and more. Common issues found in West Virginia homes include:

- Moisture intrusion and basement dampness (common in mountain terrain)

- Aging HVAC systems and insulation deficiencies

- Well and septic system concerns

- Foundation settling, particularly in areas with clay soils

- Roof wear from WV's variable weather

After inspection, buyers typically request repairs or credits. You can agree, negotiate, decline, or offer a credit in lieu of repairs. The key is responding thoughtfully within the contract timeline.

Appraisal Considerations

If the buyer is financing, their lender orders an appraisal to confirm the home's value supports the loan amount. If the appraisal comes in below the contract price, you have options:

- Reduce the price to the appraised value

- Buyer covers the gap with additional cash

- Split the difference between appraised value and contract price

- Challenge the appraisal with additional comparable sales data

- Cancel the contract if no agreement can be reached

Step 8: Close the Sale

Closing is the final step where ownership transfers from you to the buyer. West Virginia has specific requirements that differ from some other states.

West Virginia Closing Requirements

Attorney requirement: West Virginia law requires an attorney be present at closing. This attorney—typically chosen by the buyer's lender or the parties—handles title examination, document preparation, and oversees the closing process. Attorney fees typically range from $750 to $1,250 for straightforward closings.

Title insurance: Buyers typically purchase lender's title insurance (required for mortgage), and sellers often pay for owner's title insurance as part of closing costs.

Typical Closing Timeline in West Virginia

What to Bring to Closing

- Government-issued photo ID

- All house keys, garage remotes, and access codes

- Any documents requested by the closing attorney

- Cashier's check if you owe funds at closing (rare for sellers)

After signing, the deed is recorded with the county clerk, and funds are disbursed. You'll typically receive your proceeds via wire transfer within 1 to 4 business days.

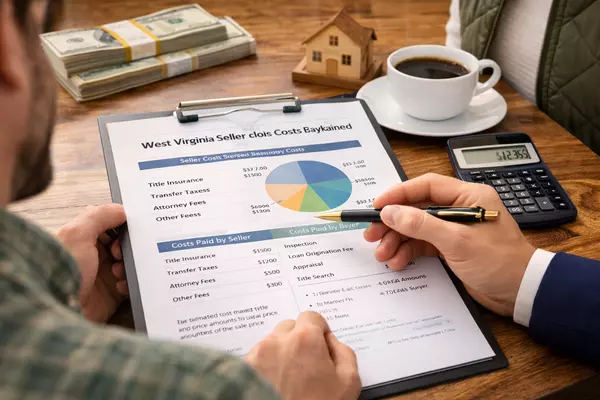

West Virginia Seller Closing Costs

Understanding your costs helps you accurately estimate net proceeds. West Virginia sellers typically pay 8% to 10% of the sale price in total costs, including commissions.

| Cost Item | Typical Amount | Notes |

|---|---|---|

| Real Estate Commission | 5.65% average | Negotiable; reduced-fee options available |

| Transfer Tax | $1.10 per $500 (0.22%) | Paid to state; typically seller's responsibility |

| Attorney Fees | $750 – $1,250 | Required by WV law; varies by complexity |

| Title Insurance (Owner's) | 0.5% – 1.0% | Protects buyer; often seller-paid |

| Prorated Property Taxes | Varies | Based on time owned in calendar year; WV avg rate 0.51% |

| Recording Fees | $50 – $150 | To officially record deed transfer |

| HOA Transfer Fees | $0 – $500 | If applicable |

| Buyer Incentives/Credits | 0% – 3% | Negotiated; closing cost assistance or repair credits |

Example: Selling a $243,000 Home in West Virginia

| Sale Price | $243,000 |

| Commission (5.65%) | – $13,730 |

| Transfer Tax (0.22%) | – $535 |

| Attorney Fees | – $1,000 |

| Title Insurance + Other | – $2,500 |

| Estimated Net (before mortgage payoff) | $225,235 |

*Actual costs vary. Use a seller net sheet calculator for personalized estimates.

West Virginia Disclosure Requirements

West Virginia follows a "caveat emptor" (buyer beware) approach to real estate disclosures. Unlike most states, West Virginia does not legally require sellers to fill out a comprehensive disclosure form. However, this doesn't mean you can hide known defects.

What You Must Know

No mandatory state disclosure form: West Virginia law does not require a specific seller disclosure statement for residential properties.

Fraud prohibition applies: You cannot actively misrepresent or fraudulently conceal known defects. If a buyer asks about a specific issue, you must answer truthfully.

Agent disclosure requirements: Licensed real estate agents in West Virginia must disclose "material facts" they know about. Your agent cannot lie or misrepresent the property on your behalf.

Federal lead disclosure: For homes built before 1978, federal law requires disclosure of known lead-based paint hazards.

| Disclosure Type | Required in WV? | Recommendation |

|---|---|---|

| Comprehensive Property Disclosure | No | Recommended for liability protection |

| Lead-Based Paint (pre-1978) | Yes | Federal requirement; use EPA form |

| Known Material Defects | Yes* | Cannot fraudulently conceal; must answer truthfully |

| Well/Septic Information | No | Highly recommended; buyers often require |

| Mine Subsidence Areas | No | Important for affected regions of WV |

Why Disclose Anyway?

Even without legal requirements, proactive disclosure offers significant benefits:

- Reduces legal liability: Documented disclosures protect against future claims

- Builds buyer confidence: Transparency encourages stronger offers

- Prevents renegotiation: Issues disclosed upfront won't surprise buyers during inspection

- Speeds the process: Informed buyers move forward with fewer delays

Many West Virginia sellers choose to complete a voluntary disclosure form, available through the West Virginia Association of Realtors or your real estate agent.

West Virginia Home Selling Timeline

From first preparation to closing day, here's what to expect:

PHASE 1

Prep & List

1-3 weeks

PHASE 2

Market & Show

4-10 weeks

PHASE 3

Under Contract

4-6 weeks

TOTAL

Listing to Closing

9-19 weeks

The biggest variable is time on market, which ranges from under 30 days in hot areas like the Eastern Panhandle to 90+ days in rural southern West Virginia. Accurate pricing is the single most important factor in reducing days on market.

Common Mistakes West Virginia Sellers Make

Avoid these pitfalls that cost sellers time and money:

Costly Seller Mistakes to Avoid

| 1 | Overpricing: Homes priced above market sit longer and ultimately sell for less. In 2025, 18.6% of WV listings had price drops. |

| 2 | Poor photos: Dark, blurry, or cluttered listing photos reduce showings and offers. |

| 3 | Skipping prep work: Clutter, odors, and deferred maintenance turn off buyers. |

| 4 | Being inflexible with showings: Limited access means fewer offers. |

| 5 | Emotional negotiations: Taking offers personally leads to poor decisions. |

| 6 | Not understanding costs: Underestimating closing costs and commissions leads to budget surprises. |

| 7 | Ignoring well/septic issues: Undisclosed problems with these systems derail many WV transactions. |

| 8 | Choosing the wrong agent: Not all agents are equal—interview multiple and check track records. |

Alternatives to Traditional Home Selling

Traditional listing isn't the only path to selling your West Virginia home. Depending on your priorities—speed, convenience, or maximum price—alternative methods may suit your situation better.

Cash Buyers and Investors

Cash home buyers purchase properties directly, often in as-is condition. In West Virginia, where approximately 29% of home sales are cash transactions, these buyers are active throughout the state. The trade-off is price: expect offers 10% to 30% below market value in exchange for speed and convenience.

Cash sales may make sense when you need to sell quickly due to relocation, financial distress, or inherited property you can't maintain. For sellers exploring this cash offer option, comparing multiple offers helps ensure you get the best available price.

For Sale By Owner (FSBO)

Selling without an agent can save on listing commission but requires significant time and expertise. FSBO sellers handle pricing, marketing, showings, negotiations, and paperwork themselves. Nationally, only about 5% of sellers successfully sell FSBO, and these homes often sell for less than agent-listed properties.

Rent-to-Own or Lease Option

If your home isn't selling or you don't need immediate proceeds, a lease-option arrangement lets tenants rent with the right to purchase later. This works best for homes that need time to appreciate or in slower markets.

| Method | Speed | Net Proceeds | Effort Required |

|---|---|---|---|

| Traditional Agent Listing | 60-90 days | Highest | Low |

| Cash Buyer | 7-14 days | Lowest | Lowest |

| FSBO | Varies widely | Variable | Highest |

| Lease-Option | 1-3 years | Moderate | Moderate (ongoing) |

Buying Your Next Home After You Sell?

Whether you're moving within West Virginia or relocating out of state, having a clear buyer strategy helps coordinate your sale with your next purchase.

Get a Buyer Strategy Session →West Virginia Real Estate Glossary

Key terms you'll encounter when selling your home:

Caveat Emptor: Latin for "let the buyer beware." West Virginia's legal doctrine placing responsibility on buyers to investigate property condition.

Closing Attorney: Required in WV to oversee the closing process, examine title, and prepare deed documents.

Comparative Market Analysis (CMA): Report prepared by real estate agents comparing your home to similar recently sold properties to determine market value.

Contingency: Condition in the purchase contract that must be met for the sale to proceed (e.g., inspection, financing, appraisal).

Earnest Money: Deposit made by buyer to demonstrate serious intent; typically held in escrow until closing.

Material Defect: Significant issue that affects property value or poses safety risks; must be disclosed if known.

MLS (Multiple Listing Service): Database used by real estate agents to share property listings; syndicates to major real estate websites.

Transfer Tax: State tax paid when property ownership transfers; in WV, $1.10 per $500 of sale price.

Title Insurance: Policy protecting against title defects, liens, or ownership disputes discovered after purchase.

Frequently Asked Questions

Do I need a real estate attorney to sell a house in West Virginia?

Yes. West Virginia law requires an attorney to be present at closing. The attorney handles title examination, document preparation, and oversees the closing process. Attorney fees typically range from $750 to $1,250 for standard residential closings.

What disclosures are required when selling a home in West Virginia?

West Virginia is a "caveat emptor" state and does not require a comprehensive seller disclosure form. However, you cannot fraudulently conceal known defects, must answer buyer questions honestly, and must provide lead-based paint disclosure for homes built before 1978. Most real estate professionals recommend completing a voluntary disclosure form for liability protection.

How much does it cost to sell a house in West Virginia?

Total seller costs typically range from 8% to 10% of the sale price, including real estate commissions (averaging 5.65%), transfer tax (0.22%), attorney fees ($750-$1,250), title insurance, prorated property taxes, and other closing costs. On a $243,000 home, expect approximately $18,000 to $24,000 in total costs.

How long does it take to sell a house in West Virginia?

The median days on market in West Virginia is approximately 62 days, plus 30-45 days from contract to closing. Total timeline from listing to closing is typically 3-4 months, though this varies significantly by region—homes in the Eastern Panhandle often sell faster than those in rural southern WV.

What is the transfer tax rate in West Virginia?

West Virginia's real estate transfer tax is $1.10 per $500 of the property's sale price, which equals approximately 0.22%. The seller typically pays this tax at closing. On a $243,000 sale, the transfer tax would be approximately $535.

Should I get a home inspection before listing my West Virginia home?

A pre-listing inspection ($300-$500) is optional but can be valuable, especially for older homes common in West Virginia. It allows you to discover and address issues before buyers do, potentially avoiding renegotiation or deal-killing surprises. It's particularly recommended if you have well and septic systems.

What is the best time to sell a house in West Virginia?

Spring (April through June) typically sees the highest buyer activity in West Virginia, as families prefer moving during summer months. However, lower inventory during fall and winter can reduce competition, potentially benefiting sellers during off-peak seasons.

Do I pay capital gains tax when selling my West Virginia home?

Most West Virginia sellers don't owe capital gains tax on their home sale. If you've lived in the home as your primary residence for at least two of the past five years, you can exclude up to $250,000 in gains ($500,000 for married couples filing jointly). West Virginia generally follows federal exclusion rules. Consult a tax professional for your specific situation.

Can I sell my house in West Virginia without a real estate agent?

Yes, you can sell "For Sale By Owner" (FSBO) in West Virginia. However, FSBO requires significant time and expertise—you'll handle pricing, marketing, showings, negotiations, and legal paperwork yourself. Nationally, about 5% of sellers successfully sell FSBO, and these homes often sell for less than agent-listed properties.

What should I look for when hiring a real estate agent in West Virginia?

Look for agents with recent experience in your local market, strong track records (homes sold, average days on market, sale-to-list ratio), positive client reviews, and clear communication. Ask about their marketing plan, pricing strategy, and commission structure. Interviewing at least 2-3 agents helps you compare options. Teams like Jamil Brothers Realty Group, which has facilitated over $500 million in transactions and serves the broader Mid-Atlantic region including the Eastern Panhandle, can offer data-driven pricing and flexible commission options.

What unique issues affect home sales in West Virginia?

West Virginia's terrain and housing stock create distinct considerations: well and septic systems (common in rural areas) require documentation, some regions have mine subsidence concerns requiring specialized insurance, older homes may have foundation settling issues in clay soil areas, and mountain properties can have access or flood zone concerns. Addressing these proactively smooths the selling process.

How do I find out what my West Virginia home is worth?

The most accurate methods are: (1) Request a Comparative Market Analysis (CMA) from a local real estate agent—typically free; (2) Use online home value estimators for a starting point, recognizing they may miss local nuances; (3) Hire a professional appraiser ($300-$500) for an independent valuation. Combining multiple data points provides the clearest picture of your home's market value.

Ready to Sell Your West Virginia Home?

Get started with a free home valuation and see how much you could save with our 1.5% listing fee program—full-service representation at a fraction of traditional costs.

Final Thoughts

Selling a home in West Virginia follows a clear path when you understand each step. From preparation and pricing through marketing, negotiation, and closing, success comes from informed decisions and attention to West Virginia's specific requirements—particularly the attorney mandate at closing and the caveat emptor disclosure landscape.

Whether you're selling a cabin in the mountains, a family home in Charleston, or property in the DC-commuter Eastern Panhandle, the fundamentals remain the same: prepare thoroughly, price accurately, market effectively, and negotiate confidently.

For most sellers, working with an experienced local agent simplifies the process while maximizing results. The right agent brings market expertise, professional marketing, skilled negotiation, and the ability to navigate West Virginia's closing requirements—ideally at a commission rate that respects your bottom line.

If you're considering selling your West Virginia home, start by understanding your home's current market value. From there, you can make informed decisions about timing, pricing, and how to proceed. Looking to explore homes currently on the market? Browse available properties to see what's selling in your area.

Categories

Recent Posts

Let's Connect