How Long Does It Take to Sell a House in West Virginia? (2026 Timeline Guide)

How Long Does It Take to Sell a House in West Virginia? (2026 Timeline Guide)

If you're planning to sell a house in West Virginia, one of your first questions is likely about timing. The Mountain State's real estate market operates differently than neighboring Virginia or Maryland, with significant variations between bustling areas like Charleston and Morgantown versus the quieter rural hollows and mountain communities. Understanding these timelines helps you plan your move, coordinate finances, and set realistic expectations for your sale.

This comprehensive guide breaks down exactly how long it takes to sell a home in West Virginia in 2026, examines the dramatic differences between urban and rural markets, and provides actionable strategies to help you sell faster without sacrificing your bottom line.

Quick Answer

In 2026, West Virginia homes spend an average of 42 to 62 days on market before going under contract, followed by a 30 to 35 day closing period. Total timeline from listing to keys changing hands: approximately 75 to 96 days. However, this varies dramatically by location—the Eastern Panhandle averages just 18 days to contract while rural southern counties can take 85 to 110 days.

Key Takeaways

- Statewide average: 42 to 62 days on market plus 30 to 35 days to close (roughly 3 months total)

- Fastest markets: Eastern Panhandle (18 days average), Charleston metro, and Morgantown

- Slowest markets: Rural southern counties (85 to 110+ days), remote mountain properties

- Price matters: Homes under $200K in desirable areas sell in 21 days; homes over $400K average 76 days

- Condition impact: Move-in ready homes sell 52% faster than those needing significant updates

- Best month to sell fast: April (50 days average); slowest is January (73 days)

- Best month for top dollar: June listings fetch 5.8% more than the annual average

Table of Contents

- 1. The Complete West Virginia Selling Timeline

- 2. 2026 Statewide Market Numbers at a Glance

- 3. Urban Markets: Charleston, Morgantown & Huntington

- 4. The Eastern Panhandle Advantage

- 5. Rural West Virginia: A Different Timeline

- 6. Key Factors That Affect Your Selling Timeline

- 7. Seasonal Selling Patterns in WV

- 8. How to Sell Your WV Home Faster

- 9. Common Mistakes That Delay WV Home Sales

- 10. Alternatives If You Need to Sell Quickly

- 11. Understanding the West Virginia Closing Process

- 12. Frequently Asked Questions

- 13. Glossary of Key Terms

The Complete West Virginia Selling Timeline

Selling a home in West Virginia involves multiple phases, each with its own typical duration. Understanding these phases helps you plan effectively and avoid surprises. The total process—from deciding to sell to handing over the keys—typically takes 3 to 5 months for most West Virginia homeowners.

West Virginia Home Sale Timeline (2026)

Pre-Listing Preparation: Agent selection, pricing strategy, home prep, professional photos, disclosure completion

Active Listing Period: MLS listing, showings, open houses, offer negotiations (*varies significantly by region)

Under Contract to Close: Inspections, appraisal, title search, loan processing, final walkthrough, closing

Total Average Timeline: 75–96 days (approximately 2.5–3.5 months)

These figures represent statewide averages. Your actual timeline depends heavily on your specific location within West Virginia, your home's condition and price point, current market conditions, and how well your property is marketed and priced from day one.

2026 Statewide Market Numbers at a Glance

Before diving into regional differences, here's where the West Virginia housing market stands in early 2026. The market has transitioned toward more balanced conditions, with modest price growth and improved inventory compared to the seller-dominated market of recent years.

West Virginia Housing Market Snapshot (January 2026)

$242,900

Median Sale Price

↑ 3.9% year-over-year

62

Median Days on Market

Balanced market range

0.7

Months of Supply

Low inventory statewide

99%

Sale-to-List Price Ratio

Sellers near asking price

These statewide numbers mask enormous regional variation. The Eastern Panhandle operates almost like a D.C. suburb, with fast sales and higher prices, while coal country and remote mountain communities follow a completely different rhythm. Understanding your specific market is essential for setting realistic expectations.

| Market Type | Avg. Days to Contract | Typical Price Range | Competition Level |

|---|---|---|---|

| Eastern Panhandle | 18 days | $245K–$335K | High |

| Charleston Metro | 35–42 days | $162K–$245K | Moderate |

| Morgantown Area | 30–40 days | $267K–$425K | High |

| Huntington Area | 45–55 days | $80K–$157K | Moderate |

| Rural/Southern Counties | 85–110+ days | $80K–$175K | Low |

Curious What Your West Virginia Home Is Worth Today?

Get a data-driven home valuation based on current market conditions in your specific area. Understanding your home's true market value is the first step toward a successful sale.

Urban Markets: Charleston, Morgantown & Huntington

West Virginia's urban and suburban markets generally follow patterns similar to other mid-sized metropolitan areas, though with lower price points that make homeownership more accessible. Here's what sellers can expect in the state's three largest metros.

Charleston Metro Area

As West Virginia's capital and largest city, Charleston offers a relatively active real estate market driven by state government employment, healthcare, and professional services. The metro area includes sought-after neighborhoods like South Hills, Kanawha City, and the East End, each with distinct characteristics and demand patterns.

Homes in Charleston typically go under contract within 35 to 42 days when priced correctly. The average home value sits around $162,000, though premium neighborhoods command $375,000 or more. Charleston has seen approximately 6.2% annual appreciation, making it one of the more stable markets in the state.

Charleston Quick Stats

Median home value: $162,212 | Time to pending: ~10 days | Annual appreciation: 4.0% | Inventory: Rising 35% YoY

Morgantown

Home to West Virginia University, Morgantown enjoys consistent demand fueled by the university's 27,000+ students, a robust healthcare sector (WVU Medicine), and a growing tech presence. This creates a dual market of owner-occupied homes and investment properties.

Morgantown commands the highest median home prices among West Virginia's major cities at $267,000, with premium neighborhoods near Cheat Lake reaching $425,000 or higher. Homes typically sell within 30 to 40 days. The area has experienced 8.1% annual appreciation, the strongest among major metros, driven by limited inventory and sustained demand.

Huntington-Ashland Metro

The Huntington area presents a different picture. While Marshall University and Cabell Huntington Hospital provide economic anchors, the market moves slower than Charleston or Morgantown. Expect 45 to 55 days on market for appropriately priced homes.

The trade-off is exceptional affordability. With a median home price of approximately $157,000 and steady 4.8% appreciation, Huntington offers one of the lowest barriers to homeownership in the eastern United States. Sellers should expect fewer showings but more serious buyers.

The Eastern Panhandle Advantage

If you're selling in Berkeley, Jefferson, or Morgan County, you're operating in West Virginia's fastest and most competitive market. The Eastern Panhandle functions less like traditional West Virginia and more like a D.C. suburb, attracting commuters, remote workers, and retirees fleeing higher-cost markets in Maryland and Northern Virginia.

Eastern Panhandle Market Performance

18

Days on Market (Avg)

9.3%

Annual Appreciation

$335K

Median Price (Berkeley)

23.6%

Charles Town YoY Growth

Key communities driving this activity include Martinsburg and Charles Town in Berkeley and Jefferson Counties. Charles Town has seen particularly explosive growth, with a remarkable 23.6% year-over-year increase in sales prices. Shepherdstown, a historic college town, experienced 35% appreciation over five years, the highest among smaller communities statewide.

What makes the Eastern Panhandle different:

- D.C./Baltimore commuter demand: Many buyers work in the capital region and commute via MARC train or I-81

- Remote work migration: Post-pandemic, this area attracted significant numbers of remote workers seeking lower costs and more space

- Strong school districts: Jefferson County schools rank among the state's best, with test scores 15% above state averages

- Weekend buyer activity: Commuter buyers often schedule weekday evening showings, keeping demand consistent

If you're selling in the Eastern Panhandle, expect multiple showings within days of listing, potential competing offers, and a timeline closer to 3 to 4 weeks to contract rather than the 2-month statewide average.

Rural West Virginia: A Different Timeline

Rural properties in West Virginia operate on an entirely different schedule. If you're selling in McDowell, Logan, Mingo, Wyoming, or other southern and remote mountain counties, prepare for a longer process with fewer but more serious buyers.

Rural properties typically require 85 to 110 days on market, sometimes longer. Several factors contribute to extended timelines:

Why Rural WV Homes Take Longer to Sell

- ☐ Smaller buyer pool due to population decline (48 of 55 counties losing population)

- ☐ Limited financing options for properties with septic, wells, or non-standard features

- ☐ Buyer concern about mine subsidence in coal regions

- ☐ Access challenges including steep driveways and unpaved roads

- ☐ Lack of high-speed internet (critical for remote workers)

- ☐ Distance from employment centers, healthcare, and amenities

- ☐ Complex documentation requirements for wells, septic, and private roads

However, rural properties attract specific buyer profiles who prioritize privacy, land, and lower costs over convenience. Your ideal buyer may be a retiree, remote worker, vacation property seeker, or someone building a homestead. Marketing should target these demographics specifically.

| Factor | Urban/Suburban WV | Rural WV |

|---|---|---|

| Avg. Days on Market | 18–42 days | 85–110+ days |

| Showings Per Week | 5–15 | 1–3 |

| Buyer Financing | Conventional, FHA, VA | Often cash or USDA |

| Inspection Concerns | Standard | Well, septic, mine surveys |

| Negotiating Position | Balanced to Seller | Often Buyer |

Want to Know Exactly What You'll Walk Away With?

Use our free Seller Net Sheet calculator to see your estimated proceeds after commissions, closing costs, and any remaining mortgage balance. No surprises at the closing table.

Key Factors That Affect Your Selling Timeline

Beyond location, several other variables determine how quickly your West Virginia home will sell. Understanding these factors helps you take control of your timeline.

Price Point Matters Significantly

Your home's price directly correlates with time on market. The sweet spot in West Virginia is below $200,000 in desirable areas, where homes average just 21 days on market. As prices rise, timelines extend.

Days on Market by Price Point (2026)

*Luxury segment has improved significantly from 145 days in 2023

Property Condition

Move-in ready homes sell 52% faster than those requiring significant updates. This gap has widened in recent years as buyers increasingly prefer turnkey properties they can move into immediately. In West Virginia, where older housing stock is common, condition can make or break your timeline.

West Virginia-specific condition concerns that slow sales include:

- Foundation issues related to clay soil (common in Charleston, Huntington, Parkersburg)

- Mine subsidence concerns (over 40% of southern WV sits over abandoned mines)

- Septic system age and condition (critical for rural properties)

- Well water quality and documentation

- Radon levels (WV averages 4–12+ pCi/L in coal seam areas)

- Flood zone designation

Pricing Strategy

Overpricing is the number one reason homes sit on the market too long. Local agents consistently report that homes priced correctly from day one sell faster and often for more money than those that start high and require price reductions.

The statewide sale-to-list price ratio of 99% indicates that sellers who price correctly are getting their asking price. However, this also means buyers expect fair pricing and won't overpay significantly. Work with an agent who provides a thorough comparative market analysis (CMA) specific to your neighborhood.

Seasonal Selling Patterns in West Virginia

Like most markets, West Virginia real estate follows seasonal patterns. However, the Mountain State's terrain and weather create more pronounced seasonal effects than many other regions.

| Month | Avg. Days on Market | Best For | Notes |

|---|---|---|---|

| January | 73 days | Serious buyers only | Slowest month; winter weather limits showings |

| April | 50 days | Selling fast | Fastest month; spring buyers active |

| June | 55 days | Maximum price | 5.8% higher prices than annual average |

| September | 58 days | Family buyers | Post-summer rush before holidays |

| November | 68 days | Motivated buyers | Lower competition; holiday slowdown begins |

For rural properties, seasonal effects are even more pronounced. Mountain access roads may be impassable in winter, and properties "show" best when foliage and outdoor features are visible. Spring and early summer typically yield the best results for rural and recreational properties.

How to Sell Your West Virginia Home Faster

While you can't control the market, you can take specific actions to minimize your time on market and attract qualified buyers faster.

1. Price It Right From Day One

This is the single most important factor. Data consistently shows that homes priced correctly from the start sell faster and for more money than those requiring price reductions. Once a home sits past 30 days, buyers assume something is wrong and begin submitting lowball offers.

2. Invest in Professional Photography

In West Virginia's spread-out market, buyers often drive significant distances for showings. Quality photos determine whether they make that trip. Dark, amateur smartphone photos result in fewer showings and longer market times.

3. Address Major Concerns Pre-Listing

Consider a pre-listing inspection to identify issues that could derail a sale. In West Virginia, this might include:

Pre-Listing Inspection Priorities for WV Sellers

- ☑ Septic system inspection and pump records (rural properties)

- ☑ Well water testing and flow rate documentation

- ☑ Radon testing (especially in coal regions)

- ☑ HVAC service records

- ☑ Roof inspection for homes over 15 years

- ☑ Foundation assessment if in clay soil areas

- ☑ Mine subsidence documentation (southern WV)

4. Stage for Your Buyer Demographic

Different West Virginia markets attract different buyers. Morgantown draws young professionals and families; the Eastern Panhandle attracts D.C. commuters; rural areas appeal to retirees and remote workers. Stage your home to appeal to your most likely buyer.

5. Be Flexible With Showings

In the Eastern Panhandle, commuter buyers often schedule weekday evening showings. In rural areas, weekend showings may be the only practical option. Accommodate as many showings as possible, especially in the critical first two weeks.

Sell Your Home With a 1.5% Listing Fee

Why pay 2.5–3% on the listing side when you can get full-service representation—professional marketing, expert negotiation, and comprehensive support—for just 1.5%? Keep more of your equity without sacrificing quality.

Common Mistakes That Delay West Virginia Home Sales

Avoid these pitfalls that consistently cause homes to sit on the market longer than necessary.

Top Timeline-Killing Mistakes

❌ Overpricing Based on "What You Need"

The market doesn't care what you owe or what you want to net. Price based on comparable sales, not personal financial needs. Homes priced even 5% too high can sit for months.

❌ Neglecting Curb Appeal

Many West Virginia properties feature large lots and mature landscaping. Overgrown yards, peeling paint, and cluttered porches signal "neglected" to buyers before they walk inside.

❌ Being Present During Showings

Buyers can't picture themselves in your home when you're watching. Leave during showings and let them explore freely.

❌ Hiding Known Problems

West Virginia law requires disclosure of known defects. Hiding issues doesn't make them disappear—it makes deals fall apart during inspection and can expose you to lawsuits.

❌ Limiting Showing Availability

Every showing you decline is a potential buyer lost. Be as flexible as possible, especially in the first two weeks when your listing has maximum visibility.

Alternatives If You Need to Sell Quickly

Sometimes circumstances require a faster timeline than the traditional market allows. Here are your options with honest assessments of each.

| Option | Timeline | Expected Price | Best For |

|---|---|---|---|

| Traditional Sale | 75–96 days | 100% market value | Maximum price, flexible timeline |

| Cash Buyer Company | 7–14 days | 65–75% market value | Urgent situations, distressed properties |

| iBuyer | 14–30 days | 85–95% market value | Move-in ready homes, convenience priority |

| Aggressive Pricing | 14–30 days | 95–98% market value | Good homes, faster timeline needed |

Cash buyers and iBuyers typically offer 15–35% below market value in exchange for speed and convenience. While this may make sense for properties in poor condition or urgent situations, most sellers are better served by the traditional market, even with aggressive pricing.

If you're considering a faster cash offer option, make sure you understand what you're giving up in terms of price before committing. Getting multiple offers and comparing them to your estimated market value helps ensure you're making an informed decision.

Understanding the West Virginia Closing Process

Once you've accepted an offer, the closing process in West Virginia typically takes 30 to 35 days for conventional financing. Here's what happens during that period.

West Virginia Closing Process Timeline

Days 1–3: Contract Execution

Signed contract delivered to title company, earnest money deposited in escrow

Days 3–10: Inspection Period

Buyer conducts home inspection, negotiations over repairs if needed (WV default: 10-day contingency)

Days 5–15: Title Search

Title company verifies ownership, checks for liens, prepares title commitment

Days 10–25: Appraisal & Loan Processing

Lender orders appraisal, processes loan documents, underwrites mortgage

Days 28–32: Final Preparations

Lender issues "clear to close," closing documents prepared, final walkthrough scheduled

Day 30–35: Closing Day

Seller signs deed and closing affidavit, buyer signs loan documents, funds disbursed, deed recorded

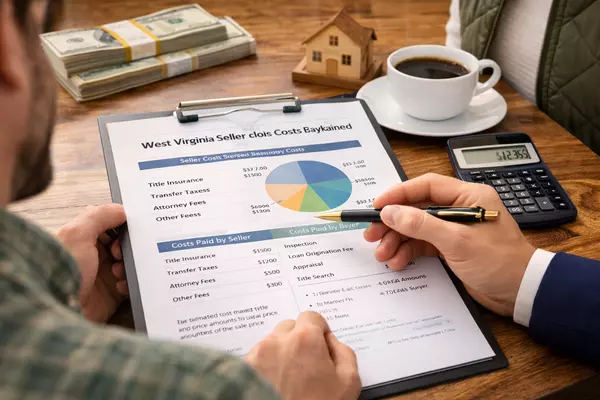

In West Virginia, closings are typically overseen by a title company or real estate attorney. The seller generally signs first, and you can often complete your portion electronically. Closing costs for sellers in West Virginia average around 1.5–2% of the sale price (not including agent commissions), covering transfer taxes, title fees, and prorated property taxes.

West Virginia charges specific transfer taxes: $1.10 per $1,000 of sale price at the state level, plus an additional $2.20 to $6.60 per $1,000 depending on county rates.

Planning to Buy After You Sell?

Coordinating a sale and purchase requires careful timing and strategy. Get a personalized buyer consultation to understand your options, financing, and timeline.

Frequently Asked Questions

How long does it take to sell a house in Charleston, WV?

Charleston homes typically go under contract within 35 to 42 days when priced correctly. Premium neighborhoods like South Hills may move faster, while properties needing updates can take longer. Including the closing period, expect a total timeline of approximately 70 to 80 days from listing to keys changing hands.

Why do rural West Virginia homes take so much longer to sell?

Rural properties face a smaller buyer pool due to population decline, limited financing options for properties with wells and septic systems, buyer concerns about mine subsidence or access issues, and distance from employment centers. These factors combine to extend timelines to 85–110 days or longer, though serious buyers who do make offers tend to be highly motivated.

What is the best month to sell a house in West Virginia?

For speed, list in April when homes average just 50 days on market. For maximum price, June listings fetch 5.8% more than the annual average. Avoid January if possible, when homes sit an average of 73 days and winter weather limits showings, especially for rural and mountain properties.

How much faster does a move-in ready home sell compared to one needing work?

Move-in ready homes in West Virginia sell 52% faster than those requiring significant updates. This gap has widened in recent years as buyers increasingly prefer turnkey properties. Even modest improvements like fresh paint, updated fixtures, and deep cleaning can significantly reduce your time on market.

Is the Eastern Panhandle housing market different from the rest of West Virginia?

Significantly. The Eastern Panhandle (Berkeley, Jefferson, and Morgan counties) functions more like a Washington D.C. suburb than traditional West Virginia. Homes sell in an average of just 18 days, prices run 30–40% higher than statewide averages, and the market has seen 9.3% annual appreciation—the highest in the state. If you're selling here, expect multiple showings within days of listing.

How do I choose the best real estate agent to sell my house in West Virginia?

Look for an agent with specific experience in your local market (not just statewide), a track record of sales similar to your property type, strong marketing capabilities including professional photography, and transparent communication. Ask for their average days on market compared to the local average, their sale-to-list price ratio, and references from recent clients. Teams like Jamil Brothers Realty Group, which has helped over 800 buyers and sellers and is recognized as NVAR Lifetime Top Producers, can bring extensive market knowledge and resources that benefit sellers.

What closing costs do sellers pay in West Virginia?

West Virginia sellers typically pay 1.5–2% of the sale price in closing costs, separate from agent commissions. This includes state excise tax ($1.10 per $1,000), county transfer tax ($2.20–$6.60 per $1,000), title fees, prorated property taxes, and any negotiated seller concessions. On a $250,000 sale, expect $3,500–$5,000 in closing costs before commissions.

Can I sell my West Virginia home faster by accepting a cash offer?

Yes, cash sales can close in as little as 7–14 days since they skip mortgage approval. However, cash buyers typically offer 65–75% of market value. For most sellers, the 15–35% price reduction isn't worth the speed gain. Consider cash offers only if you have an urgent timeline, your property needs significant repairs that would fail financing requirements, or the traditional market in your area is extremely slow.

How does mine subsidence affect selling a home in southern West Virginia?

Over 40% of southern West Virginia sits above abandoned mines, and subsidence concerns can complicate sales. Buyers often require mine surveys (costing $300–$500), lenders may deny financing for affected properties, and Mine Subsidence Insurance may be required. Properties with documented subsidence may need $55,000–$195,000 in grouting or repairs. If your property is in a mine area, disclose this upfront and consider a pre-listing survey to address concerns proactively.

What happens if my West Virginia home doesn't sell within 60 days?

If your home hasn't sold within 60 days, it's time to reassess. The most common cause is overpricing—consider a price reduction of 3–5%. Also evaluate your listing photos, marketing reach, showing feedback, and property condition. Your agent should be providing weekly updates with specific recommendations. Sometimes refreshing the listing with new photos and updated description can restart buyer interest.

Is the West Virginia housing market good for sellers in 2026?

The 2026 market favors sellers in most areas, with low inventory (0.7 months of supply), prices up 3–4% year-over-year, and sale-to-list ratios near 99%. However, it's more balanced than the extreme seller's market of 2021–2022. Sellers who price correctly can expect strong results; those who overprice will struggle. The Eastern Panhandle and Morgantown remain the strongest seller's markets, while rural areas offer more negotiating power to buyers.

How long does the West Virginia closing process take?

Once you've accepted an offer, expect 30–35 days to close with conventional financing. Cash transactions can close in 7–14 days. The closing process includes inspections (10-day contingency), appraisal, title search, loan processing, and final document preparation. West Virginia closings are typically overseen by a title company or real estate attorney, with sellers often able to sign their documents electronically.

Glossary of Key Terms

Days on Market (DOM)

The number of days from when a property is listed until it goes under contract. Does not include the closing period.

Months of Supply

How long it would take to sell all current listings at the present sales pace. Under 4 months indicates a seller's market; over 6 months indicates a buyer's market.

Sale-to-List Price Ratio

The final sale price divided by the original list price, expressed as a percentage. 100% means homes sell at asking price; above 100% indicates bidding wars.

Comparative Market Analysis (CMA)

A report comparing your home to similar recently sold properties to determine appropriate listing price. Typically prepared by your real estate agent.

Earnest Money

A deposit made by the buyer when an offer is accepted, showing good faith intent to purchase. Typically held in escrow and applied to closing costs.

Mine Subsidence

Ground settling or sinking caused by the collapse of underground mine voids. Common concern in southern West Virginia's coal regions.

Title Search

Examination of public records to verify ownership and identify any liens, claims, or encumbrances on the property.

Escrow

A neutral third party that holds funds and documents during the transaction, disbursing them only when all contractual conditions are met.

Ready to Sell Your West Virginia Home?

Whether you're in the fast-paced Eastern Panhandle, the Charleston metro, or a quiet mountain community, the right strategy makes all the difference. Get a free home value estimate and see how our 1.5% listing fee program keeps more money in your pocket without sacrificing service.

The Bottom Line

Selling a house in West Virginia takes an average of 75 to 96 days from listing to closing, but your actual timeline depends heavily on where you're located. The Eastern Panhandle's 18-day average stands in stark contrast to rural southern counties where 100+ days isn't unusual.

The factors you can control—pricing strategy, property condition, professional marketing, and showing flexibility—have significant impact on your timeline. Homes priced correctly and presented well consistently outperform the market averages.

Whatever your timeline needs, start with accurate information about your home's value and the current conditions in your specific market. From there, you can make informed decisions about pricing, timing, and whether the traditional market or alternative options best serve your goals.

Market data sourced from Redfin, Zillow, and industry reports. Timelines and prices are estimates based on current market conditions and may vary by property. Consult with a local real estate professional for guidance specific to your situation.

Categories

Recent Posts

Let's Connect