How to Sell a House Without a Realtor in West Virginia (FSBO Guide)

How to Sell a House Without a Realtor in West Virginia: Complete 2026 FSBO Guide

Thinking about selling your West Virginia home yourself? You're not alone. Every year, thousands of Mountain State homeowners explore the "For Sale By Owner" (FSBO) route, hoping to save on commission costs and maintain more control over the sale process. But before you plant that yard sign in Charleston, Morgantown, or Huntington, you'll want to understand exactly what's involved—from legal requirements and disclosure rules to flat fee MLS options and realistic cost savings.

This comprehensive guide walks you through every step of selling a house without a realtor in West Virginia, including the forms you'll need, how to get MLS exposure, what closing costs to expect, and whether FSBO actually makes financial sense in 2026.

Quick Answer

Yes, you can legally sell your home without a realtor in West Virginia. However, you'll need to handle pricing, marketing, negotiations, legal paperwork, and closing coordination yourself. Most FSBO sellers use a flat fee MLS service ($99–$499) to get their listing on the MLS. Keep in mind that FSBO homes typically sell for 15–18% less than agent-assisted sales nationally, so the commission savings may not translate to higher net proceeds.

Key Takeaways

- FSBO is at an all-time low—only 5–6% of homes sold by owner in 2025, while 91% of sellers used agents.

- West Virginia is a "caveat emptor" state—but you must still answer buyer questions truthfully and disclose known material defects.

- An attorney is required for real estate closings in West Virginia (expect $750–$1,250).

- Flat fee MLS services cost $99–$499 and get your home on the same MLS agents use.

- FSBO homes sell for ~$55,000–$65,000 less than agent-assisted homes on average nationally.

- Post-NAR settlement, you're no longer required to pay a buyer's agent commission—but most sellers still offer 2–3% to attract buyers.

- WV transfer tax is $1.10 per $500 (about 0.22% of sale price), plus 0.51% average property tax proration.

Table of Contents

- What Is FSBO and Is It Right for You?

- 2026 FSBO Statistics: The Reality Check

- West Virginia Legal Requirements for FSBO

- Step-by-Step FSBO Process in West Virginia

- Getting on the MLS: Flat Fee Options in WV

- How to Price Your West Virginia Home

- Required Paperwork and Contracts

- FSBO Closing Costs in West Virginia

- Pros and Cons of Selling FSBO in WV

- Common FSBO Mistakes to Avoid

- Alternatives to Full FSBO

- How the NAR Settlement Affects FSBO Sellers

- Frequently Asked Questions

- FSBO Glossary

What Is FSBO and Is It Right for You?

FSBO (pronounced "fizz-bo") stands for "For Sale By Owner." It means selling your property without hiring a real estate agent to represent you. Instead, you handle everything traditionally done by a listing agent: pricing, marketing, photography, showings, negotiations, paperwork, and coordinating the closing.

The primary appeal is financial. Traditional listing agents in West Virginia typically charge 2.5–3% of the sale price. On a $250,000 home, that's $6,250–$7,500 you could potentially save. But "potentially" is the key word—whether you actually pocket more money depends on many factors, including your final sale price and whether you pay a buyer's agent commission.

FSBO Makes the Most Sense When:

- You already have a buyer lined up (38% of FSBO sellers sell to someone they know)

- You have significant real estate or sales experience

- You have ample time to manage the entire process

- Your home is in a hot market with strong buyer demand

- The property is straightforward (no title issues, liens, or complex situations)

✓ Are You a Good FSBO Candidate?

| Do you have 10+ hours/week to dedicate? | ☐ Yes ☐ No |

| Are you comfortable negotiating directly? | ☐ Yes ☐ No |

| Can you handle legal paperwork confidently? | ☐ Yes ☐ No |

| Is your timeline flexible (60+ days)? | ☐ Yes ☐ No |

| Do you have a buyer in mind already? | ☐ Yes ☐ No |

If you answered "No" to 3+ questions, FSBO may be challenging without professional support.

2026 FSBO Statistics: The Reality Check

Before deciding to go FSBO, it's important to understand what the data actually shows. According to the National Association of Realtors' 2025 Profile of Home Buyers and Sellers, FSBO sales have hit an all-time low—just 5% of all home sales. Meanwhile, 91% of sellers worked with an agent, a record high.

Key Numbers At-a-Glance

5%

FSBO Market Share (2025)

$360K

Median FSBO Sale Price

$425K

Median Agent-Assisted Price

36%

FSBO Sellers Making Legal Mistakes

The price gap is significant: FSBO homes nationally sold for a median of $360,000, while agent-assisted homes sold for $425,000—a difference of $65,000, or about 18%. Even accounting for the listing commission you'd save (roughly $10,625–$12,750 on a $425,000 home), many FSBO sellers end up with less money than they would have with an agent.

That said, there are legitimate scenarios where FSBO makes sense. The key is going in with realistic expectations and proper preparation—especially in a state like West Virginia with specific legal requirements.

FSBO Market Share Decline (1985–2025)

1985: 21%

2000: 13%

2015: 8%

2025: 5% (All-Time Low)

Source: National Association of Realtors Annual Surveys

Wondering What You'd Actually Net From Your Sale?

Before committing to FSBO, run the numbers. Our free net sheet calculator shows exactly what you'd walk away with after closing costs—whether you sell yourself or with an agent.

Calculate Your Net Proceeds →West Virginia Legal Requirements for FSBO Sellers

West Virginia has specific legal requirements that FSBO sellers must understand. Unlike some states with extensive disclosure mandates, West Virginia follows the "caveat emptor" (buyer beware) doctrine—but that doesn't mean you're off the hook for all disclosures.

Attorney Requirement

West Virginia requires a real estate attorney for closings. This is actually helpful for FSBO sellers because you'll have professional legal guidance for the most complex part of the transaction. Expect to pay $750–$1,250 for standard closing services, or $150–$500/hour if your sale involves complications.

Disclosure Requirements

While West Virginia doesn't mandate a state-level seller disclosure form like many other states, you still have legal obligations:

| Disclosure Type | Requirement in WV |

|---|---|

| Lead-Based Paint | Required for homes built before 1978 (Federal law) |

| Known Material Defects | Must disclose if directly asked by buyers |

| State Disclosure Form | Not legally required (but recommended) |

| Fraudulent Misrepresentation | Lying about defects can lead to lawsuits |

| Local Disclosures | May vary by county—check with attorney |

Even though West Virginia is a caveat emptor state, it's wise to provide a voluntary disclosure statement. This protects you from future claims and builds trust with buyers. About 77% of real estate lawsuits are linked to disclosure issues, so being upfront can save you significant headaches.

Required Legal Documents

At minimum, a FSBO sale in West Virginia requires:

- Purchase Agreement (Sales Contract) – The binding contract between you and the buyer

- Lead-Based Paint Disclosure – Required for pre-1978 homes

- Warranty Deed – Transfers property ownership to the buyer

- Settlement Statement (HUD-1 or Closing Disclosure) – Details all financial aspects of the transaction

- Bill of Sale – For any personal property included in the sale

- Affidavit of Title – Confirms clear ownership

Step-by-Step FSBO Process in West Virginia

Selling your home without an agent requires methodical planning. Here's a comprehensive timeline for navigating the FSBO process in West Virginia from start to closing.

FSBO Timeline: 8–12 Weeks (Typical)

Week 1–2

Pre-Listing Preparation

Research comparable sales, get a preliminary title report ($500), order a pre-listing home inspection ($350–$450), gather property documents, and make necessary repairs.

Week 2–3

Set Your Price & Prepare Marketing

Analyze comps to set a competitive price. Hire a professional photographer ($150–$400). Stage your home. Write your listing description highlighting key features.

Week 3

List on MLS via Flat Fee Service

Choose a flat fee MLS service ($99–$499). Your listing will syndicate to Zillow, Realtor.com, Redfin, and local agent databases within 24–48 hours.

Week 3–6

Showings & Open Houses

Respond promptly to all inquiries. Schedule showings (weekends and evenings). Host open houses. Keep your home show-ready at all times.

Week 4–7

Review Offers & Negotiate

Evaluate offers based on price, contingencies, and closing timeline. Counter-offer as needed. Have your attorney review the final purchase agreement before signing.

Week 6–10

Under Contract: Inspections & Appraisal

Buyer conducts inspections and may request repairs. If buyer is financing, lender orders appraisal. Negotiate any repair requests or price adjustments.

Week 10–12

Closing

Work with your attorney and title company. Review the settlement statement carefully. Sign closing documents. Transfer keys and receive your proceeds.

Getting on the MLS: Flat Fee Options in West Virginia

The MLS (Multiple Listing Service) is where 86% of buyer's agents search for homes for their clients. Without MLS exposure, your FSBO listing reaches a dramatically smaller audience. The solution? Flat fee MLS services that give you full MLS access without paying a traditional listing commission.

In West Virginia, flat fee MLS services range from $99 to $499+ depending on the package. Your listing appears identical to any agent's listing on the MLS and syndicates automatically to major real estate websites like Zillow, Realtor.com, Redfin, and Trulia.

| Package Level | Price Range | Typical Inclusions | Best For |

|---|---|---|---|

| Basic | $99–$199 | MLS listing (3–6 months), 6–10 photos, Zillow/Realtor.com syndication | Experienced sellers |

| Standard | $299–$399 | 6–12 month listing, 20+ photos, contracts & forms, yard sign, unlimited changes | Most FSBO sellers |

| Premium | $399–$599+ | Until sold, max photos, contract review, broker support, transaction coordination | First-time FSBO |

What to Look for in a Flat Fee MLS Service

- Local WV broker – Avoid third-party referral sites; work directly with the listing broker

- Strong reviews – Look for 4.5+ stars on Google/Trustpilot

- Contract support – Access to West Virginia-specific forms and disclosures

- Unlimited listing changes – You'll want to adjust price or details without extra fees

- No hidden fees – Some services charge additional fees at closing

- Cancellation policy – Understand terms before you sign

Following the 2024 NAR settlement, you can now list on the MLS and set the buyer agent commission at 0%. However, be aware that offering no commission may significantly reduce buyer interest, as agents may be less likely to show your home. Most experts recommend offering at least 2–2.5% to remain competitive.

Want Full Service Without the Full Commission?

If managing everything yourself sounds overwhelming, there's a middle ground. Some agents offer full-service listing support—including professional marketing, negotiations, and closing coordination—for a flat 1.5% listing fee instead of the traditional 2.5–3%.

Learn About 1.5% Full-Service Listings →How to Price Your West Virginia Home

Pricing is the single most important factor in a successful FSBO sale—and the area where DIY sellers struggle most. According to NAR, 17% of FSBO sellers said pricing was their biggest challenge. Overpricing leads to extended time on market and eventual price cuts; underpricing leaves money on the table.

Current West Virginia Market Snapshot (2026)

Statewide Median Price

$242,900

↑ 3.9% YoY

Median Days on Market

59–62

days

Sale-to-List Ratio

96.3%

of asking price

Sold Above List

16.3%

of homes

Source: Redfin, December 2025

West Virginia Regional Price Variations

| Region/City | Median Price | YoY Change |

|---|---|---|

| Morgantown | $267,000 | +8.1% |

| Eastern Panhandle (Martinsburg) | $245,000 | +9.3% |

| Charleston Metro | $225,000 | +6.2% |

| Huntington-Ashland | $157,000 | +4.8% |

Steps to Price Your Home Accurately

- Research Recent Sales (Comps) – Look for 3–5 similar homes sold within the past 90 days, within 1 mile, with similar square footage, bedrooms, and condition.

- Adjust for Differences – Add/subtract value for features like updated kitchens, extra bathrooms, garage, lot size, and condition.

- Consider Active Competition – Check what similar homes are currently listed for. You're competing directly against these listings.

- Factor in Market Conditions – Are homes selling above or below list price in your area? How long are they taking to sell?

- Get an Appraisal (Optional) – A professional pre-listing appraisal costs $650 in West Virginia but provides an objective value estimate.

Pro Tip: Some real estate agents offer free Comparative Market Analyses (CMAs) hoping to earn your listing. If you're genuinely open to using an agent, this can be valuable—but don't request a CMA if you've already committed to FSBO, as that wastes the agent's time.

Required Paperwork and Contracts

Handling paperwork correctly is critical—36% of recent FSBO sellers admitted to making legal mistakes during their sale. West Virginia requires specific documents at different stages of the transaction. Here's your complete paperwork checklist:

FSBO Paperwork Checklist for West Virginia

Pre-Listing Phase

- ☐ Property deed (proof of ownership)

- ☐ Original purchase agreement (if available)

- ☐ Mortgage payoff statement

- ☐ Property survey (if available)

- ☐ Preliminary title report

- ☐ Home inspection report (optional but recommended)

- ☐ HOA documents (if applicable)

Listing Phase

- ☐ MLS listing agreement (with flat fee service)

- ☐ Voluntary seller disclosure statement

- ☐ Lead-based paint disclosure (pre-1978 homes)

- ☐ Property fact sheet for showings

Contract Phase

- ☐ Purchase agreement (sales contract)

- ☐ Earnest money receipt

- ☐ Counter-offer forms (if needed)

- ☐ Addenda (inspection contingency, financing contingency, etc.)

Closing Phase

- ☐ Warranty deed

- ☐ Settlement statement (Closing Disclosure)

- ☐ Affidavit of title

- ☐ Bill of sale (for included personal property)

- ☐ Transfer tax payment

- ☐ Keys, garage openers, security codes

Where to Get Forms: Flat fee MLS services typically provide access to standard real estate contracts and disclosures. You can also obtain West Virginia-specific forms from eForms or through your closing attorney. Always have your attorney review the purchase agreement before signing.

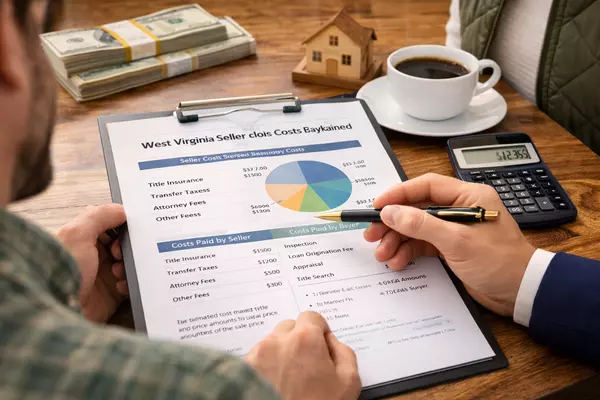

FSBO Closing Costs in West Virginia

Even without paying a listing agent commission, FSBO sellers in West Virginia face substantial closing costs. Understanding these expenses helps you accurately calculate your net proceeds.

| Cost Category | Typical Amount | Notes |

|---|---|---|

| Transfer Tax | 0.22% (~$550 on $250K) | $1.10 per $500 of sale price |

| Attorney Fees | $750–$1,250 | Required in WV; more for complex sales |

| Title Search | $75–$500 | Verifies clear ownership |

| Title Insurance (Owner's) | $500–$1,500 | Often negotiable who pays |

| Prorated Property Tax | Varies | ~0.51% avg annual rate; prorated to closing |

| Recording Fees | ~$11–$50 | Varies by county |

| Flat Fee MLS | $99–$499 | One-time, paid upfront |

| Buyer's Agent Commission* | 2–3% (optional) | Not required, but commonly offered |

| Total FSBO Costs (Without BAC) | ~2–3% | Before any buyer agent commission |

*Following the 2024 NAR settlement, sellers are no longer automatically expected to cover buyer agent commissions. However, most sellers (especially in buyer-friendly markets) still offer 2–3% to attract represented buyers. If you offer 0%, be prepared for fewer showings from agent-represented buyers.

Cost Comparison: $250,000 West Virginia Home

FSBO (Offering 2.5% BAC)

| Transfer Tax | $550 |

| Attorney | $1,000 |

| Title/Recording | $600 |

| Flat Fee MLS | $350 |

| Buyer Agent (2.5%) | $6,250 |

| Total | $8,750 (3.5%) |

Traditional Agent (5.5% Total)

| Transfer Tax | $550 |

| Attorney | $1,000 |

| Title/Recording | $600 |

| Listing Agent (3%) | $7,500 |

| Buyer Agent (2.5%) | $6,250 |

| Total | $15,900 (6.4%) |

Potential FSBO savings: ~$7,150 (assuming equal sale price)

See Exactly What You'll Walk Away With

Our free seller net sheet calculator factors in all West Virginia closing costs, including transfer taxes, attorney fees, and commission scenarios. Get a clear picture before you decide.

Calculate Your Net Proceeds →Pros and Cons of Selling FSBO in West Virginia

Before committing to FSBO, weigh the advantages against the potential drawbacks carefully. Your specific situation—experience level, timeline, and local market conditions—will determine which factors matter most.

✓ Pros of FSBO

- Save 2.5–3% listing commission ($6,250 on $250K home)

- Complete control over pricing, marketing, and negotiations

- Direct communication with buyers—no intermediary

- Flexible showing schedule on your terms

- Ideal for selling to friends, family, or known buyers

- Flat fee MLS gives you professional exposure affordably

✗ Cons of FSBO

- Homes typically sell for 15–18% less than agent-assisted

- Significant time commitment (10–20 hours/week)

- Risk of costly legal/paperwork errors (36% make mistakes)

- Limited negotiation experience vs. professional buyers' agents

- May struggle with accurate pricing

- Some buyer's agents avoid FSBO listings

- Emotional involvement can cloud judgment

Common FSBO Mistakes to Avoid

Learn from others' experiences. These are the most frequent pitfalls that derail FSBO sales in West Virginia—and how to avoid them.

⚠️ Top 8 FSBO Mistakes

1. Overpricing Based on Emotion

Your home's sentimental value doesn't translate to market value. Overpriced homes sit longer and often sell for less after multiple price cuts. Use data-driven comps, not emotional attachment.

2. Skipping Professional Photography

95% of buyers start their search online. Poorly lit smartphone photos can tank your first impressions. Invest $150–$400 in professional photos—it's one of the highest-ROI expenses.

3. Neglecting MLS Exposure

Yard signs and Craigslist alone won't cut it. 86% of buyers work with agents who search the MLS. A $300–$400 flat fee MLS listing is essential for FSBO success.

4. Offering Zero Buyer Agent Commission

While no longer required after the NAR settlement, offering 0% can drastically reduce your buyer pool. Most agents will prioritize showings where their commission is covered.

5. Not Screening Buyers

Always verify buyer financing before accepting offers. Request mortgage pre-approval letters or proof of funds for cash buyers. This avoids wasted time on unqualified buyers.

6. DIY-ing the Legal Paperwork

West Virginia requires an attorney for closings—use them earlier too. Having your attorney review the purchase agreement (not just closing docs) protects you from unfavorable terms.

7. Being Unavailable for Showings

Buyers want to see homes on their schedule—often evenings and weekends. If you can't accommodate showings within 24–48 hours of requests, you'll lose interested buyers.

8. Taking Negotiations Personally

Buyers will point out flaws and make low offers—it's part of the process. Emotional reactions can kill deals. Stay professional and focus on the numbers.

Alternatives to Full FSBO

If complete DIY selling seems overwhelming but you still want to save on commission, several middle-ground options exist:

1. Low-Commission Full-Service Agents

Some agents offer full service—professional marketing, MLS listing, negotiations, and closing support—for a reduced commission, often 1.5% instead of 2.5–3%. This gives you professional representation at a significant savings. The key is finding an agent who doesn't reduce service quality along with their fee. A reputable 1.5% listing fee model should still include professional photography, comprehensive marketing, skilled negotiations, and full representation.

2. Flat Fee MLS + Transaction Coordinator

Combine a flat fee MLS listing with a transaction coordinator who handles paperwork, deadlines, and closing logistics for a flat fee ($350–$500). You still manage showings and negotiations yourself.

3. Cash Buyer or iBuyer

If speed and convenience are priorities over maximizing price, you can sell directly to a cash buyer. These companies typically offer 70–85% of fair market value but close quickly (often 10–14 days) with no repairs, showings, or agent commissions. This might make sense if you're facing foreclosure, inherited an unwanted property, or need to relocate immediately. Learn more about the cash offer option to see if it fits your situation.

4. Hybrid Approach

Start FSBO and switch to an agent if you're not getting results after 30–60 days. About 10% of FSBO sellers eventually hire an agent. Just be aware that starting over with a new listing can reset buyer interest perceptions.

| Approach | Your Effort | Cost | Likely Sale Price |

|---|---|---|---|

| Full FSBO | High | ~2.5–3.5%* | ~15% below market |

| 1.5% Full-Service Agent | Low | ~4–4.5%* | Market value |

| Traditional Agent | Low | ~5.5–6%* | Market value |

| Cash Buyer/iBuyer | Very Low | 0% | 70–85% of value |

*Includes typical 2.5% buyer agent commission when offered

Not Sure If FSBO Is Right for You?

Get a free, no-obligation home evaluation to understand your options. We'll provide a professional market analysis and explain how different selling approaches would impact your bottom line.

Request Your Free Home Evaluation →How the NAR Settlement Affects FSBO Sellers

In August 2024, new real estate commission rules took effect following the landmark National Association of Realtors settlement. These changes directly impact FSBO sellers in several ways:

What Changed

- No more mandatory buyer agent commission – Sellers are no longer required to offer compensation to buyer's agents. You can offer 0% if you choose.

- Compensation removed from MLS – Buyer agent commissions can no longer be displayed on MLS listings. You'll need to communicate any offered commission through other channels.

- Written buyer agreements required – Buyers must now sign agreements with their agents before touring homes, clearly stating the agent's compensation.

What This Means for FSBO Sellers

The settlement theoretically benefits FSBO sellers by eliminating the perception that they must pay buyer agent commissions. However, in practice:

- Most sellers still offer compensation – Data shows average buyer agent commissions actually ticked up from 2.38% to 2.43% in 2025, as sellers in today's buyer-favorable market compete for buyers.

- FSBO homes offering no compensation may see fewer showings – Buyer's agents prioritize homes where their commission is covered.

- Buyers may ask you to cover their agent's fee – Even if you don't list a commission, buyers can request it as a seller concession in their offer.

- Greater transparency overall – The changes encourage more open conversations about who pays what, which can work in your favor as a negotiating point.

Bottom Line: The NAR settlement gives you flexibility but doesn't eliminate market realities. In West Virginia's current market, offering 2–2.5% to buyer's agents remains the norm for competitive exposure.

Frequently Asked Questions

Is it legal to sell my house without a realtor in West Virginia?

Yes, it's completely legal. West Virginia allows homeowners to sell their property themselves (FSBO). However, you'll still need a real estate attorney to handle the closing, which is required by state law. You're responsible for all other aspects traditionally handled by a listing agent.

Do I need a lawyer to sell a house in West Virginia?

Yes. West Virginia requires a real estate attorney to handle the closing. This is actually beneficial for FSBO sellers because you'll have professional legal guidance for contract review and title transfer. Attorney fees typically range from $750–$1,250 for standard transactions.

How do I get my FSBO home on the MLS in West Virginia?

Use a flat fee MLS service. These companies list your home on the MLS for a one-time fee ($99–$499) instead of the traditional percentage-based commission. Your listing will appear alongside agent listings and syndicate to Zillow, Realtor.com, Redfin, and other major sites. Popular options in West Virginia include Houzeo, Flat Fee Group, and OwnerEntry.

What disclosures are required for FSBO sellers in West Virginia?

West Virginia is a "caveat emptor" (buyer beware) state, meaning there's no mandated state disclosure form. However, you must: (1) provide the federal Lead-Based Paint Disclosure for homes built before 1978, (2) truthfully answer any direct questions from buyers about the property, and (3) avoid fraudulent misrepresentation about known defects. It's strongly recommended to provide a voluntary disclosure statement to protect yourself from future legal claims.

How much does it cost to sell a house by owner in West Virginia?

Without offering a buyer's agent commission, expect closing costs of approximately 2–3% of the sale price. This includes transfer taxes (~0.22%), attorney fees ($750–$1,250), title services ($500–$1,500), flat fee MLS ($99–$499), and prorated property taxes. If you offer a buyer's agent commission (typically 2–2.5%), add that to your total costs.

Do I have to pay a buyer's agent commission if I sell FSBO?

No, it's not required—especially after the 2024 NAR settlement. However, most FSBO sellers still choose to offer 2–2.5% to attract buyers represented by agents. If you offer 0%, buyer's agents may be less likely to show your home, potentially reducing your buyer pool. Buyers can also request you pay their agent's commission as part of their offer.

How long does it take to sell a house FSBO in West Virginia?

Timeline varies greatly depending on pricing, location, and market conditions. On average, homes in West Virginia spend about 59–62 days on market. FSBO homes often take longer due to limited marketing reach and pricing challenges. Plan for 8–12 weeks minimum from listing to closing, though well-priced homes in desirable areas may sell faster.

What is the transfer tax rate in West Virginia?

West Virginia's real estate transfer tax (excise tax) is $1.10 per $500 of the sale price, which works out to approximately 0.22%. For a $250,000 home, that's about $550. Some counties have slightly different rates—Harrison County charges $7 per $1,000, and Preston County charges $7.70 per $1,000. The seller typically pays this tax at closing.

Can I sell my house FSBO if I still have a mortgage?

Yes. Having a mortgage doesn't prevent FSBO selling. At closing, the proceeds from the sale first pay off your remaining mortgage balance, then closing costs, and you receive the remainder. Request a payoff statement from your lender before listing so you know exactly how much you owe. Ensure your sale price covers the mortgage, closing costs, and ideally leaves you with positive equity.

What if my FSBO home doesn't sell?

If your home isn't getting showings or offers after 30–60 days, consider: (1) reducing your price—overpricing is the #1 reason homes don't sell, (2) improving your photos and listing description, (3) increasing your buyer agent commission offer, or (4) hiring a professional agent. About 10% of FSBO sellers eventually hire an agent to complete the sale.

How do I choose the best real estate agent in West Virginia if I decide not to go FSBO?

Look for agents with: (1) strong local market knowledge in your specific area, (2) a proven track record of recent sales—ask for their list-to-sale price ratio and average days on market, (3) clear communication style that matches your preferences, (4) transparent commission structure with no hidden fees, (5) positive client reviews and references, and (6) professional marketing capabilities including quality photography. Interview at least 2–3 agents before deciding. Teams like Jamil Brothers Realty Group in the Northern Virginia region, for example, combine extensive transaction experience (over $500M in sales) with flexible commission options including a full-service 1.5% listing fee model.

Should I hire an inspector before listing FSBO?

A pre-listing inspection ($350–$450) is highly recommended for FSBO sellers. It helps you: (1) discover issues before buyers do, giving you time to repair or price accordingly, (2) avoid surprises during buyer inspections that could derail deals, (3) demonstrate transparency to buyers, building trust, and (4) price your home more accurately based on actual condition. In West Virginia's caveat emptor environment, knowing your home's condition protects you legally.

FSBO Glossary

Understanding real estate terminology helps you navigate the FSBO process confidently. Here are key terms you'll encounter:

Buyer's Agent Commission (BAC)

The fee paid to the real estate agent representing the buyer. Traditionally 2.5–3% of sale price, paid by the seller. Post-NAR settlement, this is now negotiable and optional for sellers.

Caveat Emptor

"Buyer beware" – a legal doctrine meaning the buyer assumes the risk of a purchase. West Virginia follows this principle, placing responsibility on buyers to inspect property before purchasing.

Closing Disclosure

A standardized form detailing all financial aspects of the transaction, including sale price, closing costs, credits, and amounts owed by each party. Replaces the older HUD-1 form.

Comparative Market Analysis (CMA)

A report analyzing recent sales of similar properties to estimate a home's market value. Real estate agents typically provide these; FSBO sellers can research comps themselves using MLS data and public records.

Contingency

A condition in the purchase agreement that must be met for the sale to proceed. Common contingencies include financing (buyer must secure mortgage), inspection (buyer can cancel if issues found), and appraisal (property must appraise at or above sale price).

Earnest Money

A deposit made by the buyer when submitting an offer, demonstrating serious intent to purchase. Typically 1–3% of purchase price. Held in escrow and applied toward closing costs or down payment.

Flat Fee MLS

A service allowing homeowners to list their property on the MLS for a one-time flat fee ($99–$499) rather than paying a traditional percentage-based listing commission.

MLS (Multiple Listing Service)

A database of properties for sale, accessible to real estate agents and syndicating to major consumer websites. Being listed on the MLS dramatically increases your home's exposure to potential buyers.

Net Sheet

A document calculating your estimated proceeds from a home sale after subtracting mortgage payoff, closing costs, and commissions. Essential for understanding your true financial outcome.

Title Insurance

Insurance protecting against defects in title or ownership claims that emerge after closing. Owner's title insurance protects the buyer; lender's title insurance protects the mortgage company.

Transfer Tax

A state or local tax charged when property ownership transfers. In West Virginia, it's $1.10 per $500 of sale price (approximately 0.22%). Sometimes called excise tax or documentary stamps.

Warranty Deed

A legal document transferring property ownership from seller to buyer, guaranteeing the seller holds clear title and has the right to sell. The most common type of deed in residential sales.

Next Steps: Making Your Decision

Selling your West Virginia home without a realtor is absolutely possible—but it requires significant time, effort, and attention to legal details. The potential commission savings are real, but so are the risks of underpricing, legal errors, and extended time on market.

If you have real estate experience, a known buyer, and ample time, FSBO can work well. If you're uncertain about pricing, negotiations, or paperwork, the "savings" from going it alone may end up costing you more than professional assistance would have.

Whatever path you choose, going in informed is the best way to protect your interests and maximize your outcome.

Ready to Explore Your Options?

Whether you're committed to FSBO or want to understand all your selling options, start by knowing your numbers. Get a free home evaluation and net proceeds estimate—no obligation.

Related Resources

Browse West Virginia Homes for Sale · Buying Your Next Home · Get a Cash Offer

Categories

Recent Posts

Let's Connect