Selling Your House As-Is in West Virginia: The Complete 2026 Guide

Selling Your House As-Is in West Virginia: The Complete 2026 Guide

Selling a house that needs work can feel overwhelming. Maybe you inherited a property with deferred maintenance, or perhaps life circumstances mean you simply cannot invest time or money into repairs. The good news? West Virginia homeowners have clear options for selling as-is, and understanding the process can help you make a confident, informed decision that protects your interests while maximizing your proceeds.

This guide covers everything West Virginia sellers need to know about as-is sales in 2026, from disclosure requirements and pricing strategies to which repairs actually matter and which ones you can safely skip.

Quick Answer

Yes, you can sell your West Virginia home as-is without making repairs. West Virginia operates as a "buyer beware" state with limited mandatory disclosure requirements, though you must still truthfully answer buyer questions and disclose known material defects. As-is homes typically sell for 10–20% below market value, but you will save on repair costs, holding time, and stress. The key is pricing strategically, marketing to the right buyers, and understanding what "as-is" actually means legally.

Key Takeaways

- West Virginia has limited disclosure requirements but sellers must still disclose known material defects and answer buyer questions honestly

- As-is sales typically net 10–20% less than fully repaired homes, but eliminate repair costs, time delays, and renovation stress

- About 29% of WV home sales in 2025 were cash transactions, meaning a significant buyer pool specifically targets as-is properties

- Strategic pricing is critical—overpriced as-is homes sit longer and ultimately sell for less than properly priced ones

- Skip cosmetic updates but address safety hazards—buyers expect wear but will walk away from dangerous conditions

- Working with an experienced agent can help you price correctly, market effectively, and negotiate as-is terms that protect you

Table of Contents

- What "As-Is" Actually Means in West Virginia

- West Virginia Disclosure Requirements for As-Is Sales

- Pros and Cons of Selling As-Is

- How to Price Your As-Is Home Correctly

- Repairs You Can Safely Skip

- Repairs That May Be Worth Doing

- Your Options for Selling As-Is

- Step-by-Step: How to Sell As-Is in WV

- Common Mistakes to Avoid

- Understanding Closing Costs for As-Is Sales

- Frequently Asked Questions

- Glossary of Key Terms

What "As-Is" Actually Means in West Virginia

When you list a property "as-is" in West Virginia, you are signaling to buyers that you will not make repairs before or after the sale. The buyer agrees to purchase the home in its current condition, accepting responsibility for any issues the property may have.

However, selling as-is does not mean you can hide problems or refuse to answer questions. Many sellers mistakenly believe as-is sales eliminate all obligations, but this is not the case. Here is what as-is actually means and does not mean:

| As-Is DOES Mean | As-Is Does NOT Mean |

|---|---|

| Seller will not make repairs | Seller can hide known problems |

| Buyer accepts current condition | Buyer cannot inspect the property |

| Price reflects property condition | Seller can lie about the home's condition |

| Streamlined negotiation process | Buyer waives all contingencies automatically |

| Faster closing timeline possible | Seller is immune from fraud liability |

The critical distinction is this: selling as-is removes your obligation to repair, but it does not remove your obligation to disclose what you know. Buyers can still order inspections, and they can still walk away if they discover problems. What they generally cannot do is demand that you fix those problems as a condition of the sale.

West Virginia's "Buyer Beware" Status

West Virginia operates under the legal doctrine of caveat emptor, or "buyer beware." This means the state places significant responsibility on buyers to investigate properties before purchasing. Unlike states with extensive mandatory disclosure forms, West Virginia does not require sellers to complete a comprehensive property condition disclosure statement.

However, West Virginia's seller disclosure laws (found in Chapter 36, Article 12 of the West Virginia Code) still require disclosure of known material defects. Material defects include issues with structural systems, water and sewer systems, electrical systems, HVAC, foundation problems, pest infestations, and environmental hazards.

West Virginia Disclosure Requirements for As-Is Sales

Even when selling as-is, West Virginia law imposes certain disclosure obligations. Understanding these requirements protects you from legal liability and helps ensure a smooth transaction.

Required Disclosures in West Virginia

What You Must Disclose (Even As-Is):

- ☑️ Lead-based paint — Required for homes built before 1978 under federal law

- ☑️ Known material defects — Issues that affect livability or value

- ☑️ Flood zone status — Past flooding or current flood zone designation

- ☑️ Structural problems — Foundation issues, roof damage, wall cracks

- ☑️ Water and sewer issues — Septic problems, well contamination, plumbing failures

- ☑️ Pest infestations — Active termite damage, rodent problems

- ☑️ Environmental hazards — Asbestos, radon, underground storage tanks

- ☑️ Mine subsidence — Especially relevant in WV coal mining regions

The federal Lead-Based Paint Hazard Reduction Act of 1992 requires all sellers of homes built before 1978 to disclose any known lead-based paint hazards, provide the EPA pamphlet "Protect Your Family From Lead in Your Home," and allow buyers a 10-day period to conduct lead testing.

Regional Considerations in West Virginia

West Virginia's diverse geography creates unique disclosure considerations depending on your property's location:

| Region | Common Issues to Consider |

|---|---|

| Southern Coal Counties (Logan, Mingo, McDowell, Wyoming) |

Mine subsidence, underground voids, abandoned mine drainage |

| River Valleys (Kanawha, Ohio, Monongahela) |

Flood zones, past water intrusion, basement moisture |

| Charleston & Huntington Metro | Clay soil foundation movement, older home systems |

| Eastern Panhandle (Jefferson, Berkeley, Morgan) |

Radon, well water quality, septic systems |

| Rural Mountain Areas | Septic system condition, limited road access, well water issues |

If you are unsure what to disclose, err on the side of transparency. Consult with a West Virginia real estate attorney if you have questions about specific issues with your property.

Wondering What Your As-Is Home Could Sell For?

Get a free, no-obligation home valuation to understand your property's current market value.

Get Your Free Home ValuePros and Cons of Selling As-Is in West Virginia

Deciding whether to sell as-is requires weighing the trade-offs. Here is a realistic assessment of the advantages and disadvantages:

| ✓ Advantages | ✗ Disadvantages |

|---|---|

| No repair costs Save $5,000–$50,000+ on renovations |

Lower sale price Expect 10–20% below market value |

| Faster timeline No waiting for contractors or permits |

Smaller buyer pool Many buyers want move-in ready homes |

| Less stress Avoid managing renovation projects |

Financing challenges Some buyers cannot get loans for distressed properties |

| Cash buyer interest Investors actively seek as-is properties |

Negotiation pressure Buyers may still request credits after inspection |

| Sell inherited homes quickly Avoid maintaining a vacant property |

Longer market time possible If priced incorrectly, as-is homes can sit |

When Selling As-Is Makes the Most Sense

Selling as-is is often the right choice when:

- You inherited a property and live out of state

- You are facing foreclosure and need to sell quickly

- Major repairs would cost more than the expected value increase

- You do not have the funds available for renovations

- The property has extensive deferred maintenance

- You are relocating and cannot oversee contractor work

- Health or personal circumstances prevent you from managing repairs

Quick Decision Guide: Should You Sell As-Is?

Do you have $10,000+ available for repairs?

Do you have 3+ months to wait for repairs and sale?

Is the estimated repair cost over 15% of home value?

How to Price Your As-Is Home Correctly

Pricing is the most critical factor in selling an as-is home successfully. Price too high, and your home sits on the market while carrying costs accumulate. Price too low, and you leave money on the table. Finding the sweet spot requires understanding both the West Virginia market and realistic repair cost estimates.

West Virginia Market Snapshot: January 2026

Key Numbers At-a-Glance

Median Home Price

$242,900

YoY Price Change

+3.9%

Median Days on Market

62 days

Cash Sales (2025)

~29%

The As-Is Pricing Formula

To price an as-is home, start with the after-repair value (ARV), which is what your home would sell for in good condition, then subtract estimated repair costs and a buyer convenience discount:

As-Is Price = ARV − Repair Costs − Buyer Discount (5–15%)

Example: $200,000 ARV − $25,000 repairs − $15,000 discount = $160,000 as-is price

The buyer discount accounts for the risk, inconvenience, and carrying costs a buyer will face while making repairs. In a competitive market, this discount may be smaller; in a slower market, it may need to be larger.

Expected Price Discounts by Property Condition

| Condition Level | Typical Issues | Typical Discount |

|---|---|---|

| Light Cosmetic | Dated décor, worn carpet, needs paint | 5–10% |

| Moderate Repairs | Aging HVAC, roof nearing end of life, kitchen/bath dated | 10–15% |

| Major Repairs Needed | Foundation issues, roof replacement, extensive water damage | 15–25% |

| Significant Distress | Multiple major system failures, structural concerns, uninhabitable | 25–40% |

Want to Know Your Net Proceeds?

Use our free seller net sheet calculator to estimate what you will actually take home after all costs.

Calculate Your Net ProceedsRepairs You Can Safely Skip When Selling As-Is

One of the biggest mistakes as-is sellers make is investing money in repairs that will not affect the sale price. If you are selling as-is, buyers already expect the home to need work. Save your money and skip these updates:

Repairs to Skip (Save Your Money)

❌ Full kitchen remodel

❌ Bathroom renovations

❌ New flooring throughout

❌ Interior painting (full house)

❌ Landscaping upgrades

❌ Window replacements

❌ Updating light fixtures

❌ Replacing appliances

❌ Adding a deck or patio

❌ HVAC replacement (if functional)

Why These Repairs Do Not Pay Off for As-Is Sales

The economics of home improvement returns work differently for as-is properties. According to industry data, even well-executed kitchen remodels only recoup about 50–75% of their cost at resale. For an as-is property targeting investors or bargain hunters, the return is often even lower because these buyers specifically want to do the work themselves to their own specifications.

Consider a $15,000 kitchen update: you might only add $8,000 to your sale price, losing $7,000. That same $15,000 left in your pocket as a price discount will attract more buyers faster.

Typical Repair Cost Recovery for As-Is Sales

Repairs That May Be Worth Doing

While most repairs can be skipped when selling as-is, a few strategic fixes may actually expand your buyer pool or prevent deals from falling apart. These typically involve safety issues, extremely low-cost improvements, or problems that would prevent financing.

| Repair | Typical Cost | Why It Matters |

|---|---|---|

| Smoke/CO Detectors | $50–$150 | Required for most sales; easy fix |

| Exposed Wiring Repairs | $100–$500 | Safety hazard that scares buyers away |

| Active Leak Repair | $150–$800 | Prevents ongoing damage during sale |

| Handrail Installation | $100–$300 | Code requirement for showings |

| Junk/Debris Removal | $200–$600 | Allows buyers to see the property |

| Basic Cleaning | $100–$400 | Shows home was maintained, not abandoned |

The Financing Factor

If your home has significant issues, it may not qualify for conventional or FHA financing. Lenders require properties to meet minimum habitability standards, including:

- Functional HVAC systems

- Safe electrical systems without exposed wiring

- No active roof leaks

- Working plumbing with hot water

- No peeling lead paint (for FHA loans on pre-1978 homes)

- No significant structural defects

If your home cannot qualify for financing, your buyer pool shrinks to cash buyers only. This is not necessarily a problem in West Virginia, where about 29% of sales are cash transactions, but it does affect your pricing and marketing strategy.

Your Options for Selling As-Is in West Virginia

West Virginia sellers have several pathways for selling as-is, each with different trade-offs in terms of price, speed, and convenience:

Option 1: List with a Real Estate Agent

Working with an experienced agent remains the most effective way to maximize your as-is sale price. A knowledgeable agent can help you price correctly, market to both investors and first-time buyers, negotiate offers, and navigate the as-is contract terms.

The average real estate commission in West Virginia is approximately 5.65%, though this is negotiable. Some agents, like those at Jamil Brothers Realty Group, offer competitive 1.5% listing fee options while still providing full-service marketing, professional photography, MLS exposure, and skilled negotiation.

Option 2: Sell to a Cash Buyer or Investor

Cash buyers, including house flippers and investment companies, specifically target as-is properties. They offer speed and certainty, often closing in 7–14 days with no financing contingencies.

The trade-off is price. Cash buyers need to profit from the transaction, so they typically offer 65–85% of market value. For a $200,000 home, that could mean offers between $130,000 and $170,000.

If you are considering a cash offer option, it is wise to compare multiple offers and have an agent or attorney review the terms before signing.

Option 3: For Sale By Owner (FSBO)

Selling without an agent saves on commission but requires you to handle pricing, marketing, showings, negotiations, and paperwork yourself. This can be particularly challenging for as-is sales, where pricing accurately is critical and negotiating with investors requires experience.

| Selling Method | Typical Price | Timeline | Effort Level |

|---|---|---|---|

| Agent (Traditional Fee) | Highest | 30–90 days | Low |

| Agent (1.5% Listing Fee) | Highest | 30–90 days | Low |

| Cash Buyer/Investor | Lowest | 7–21 days | Very Low |

| FSBO | Medium | 60–120+ days | High |

Sell Your As-Is Home for Just 1.5% Listing Fee

Get full-service representation, professional marketing, and expert negotiation while keeping more of your proceeds.

Learn About 1.5% ListingStep-by-Step: How to Sell As-Is in West Virginia

Follow this timeline to sell your as-is property efficiently:

Assess Your Property and Gather Documents

- Walk through and document current condition with photos

- Compile any records of past repairs, permits, or warranties

- Locate your deed, mortgage payoff information, and property tax records

- Consider getting a pre-listing inspection to identify issues

Interview Agents and Get Pricing Guidance

- Interview 2–3 agents with as-is sale experience

- Request comparative market analyses that account for condition

- Discuss listing fee options and marketing strategies

- Ask about their experience with investor buyers

Prepare the Property and Prepare Disclosures

- Remove personal belongings, debris, and excess furniture

- Complete minor safety repairs if needed

- Prepare disclosure documents with known issues

- Sign listing agreement with your chosen agent

List and Market Your Property

- Professional photos taken (even as-is homes need good photos)

- Property listed on MLS with clear as-is disclosure

- Marketing begins to both traditional buyers and investors

- Begin scheduling showings

Showings and Offers

- Accommodate showings, especially for investor buyers

- Review and negotiate incoming offers

- Accept offer with best combination of price, terms, and certainty

- Enter contract period

Under Contract to Closing

- Buyer conducts inspection (expect findings)

- Navigate any repair requests or credit negotiations

- Buyer completes financing (if applicable)

- Final walkthrough and closing

Common Mistakes to Avoid When Selling As-Is

Learn from other sellers' missteps to protect your sale:

🚫 Costly Mistakes to Avoid

1. Overpricing Because You "Know What It's Worth"

Emotional attachment clouds judgment. Your home is worth what buyers will pay, not what you think it should be worth or what you need from the sale. Overpriced as-is homes sit for months, accumulating carrying costs and eventually selling for less than if priced correctly from the start.

2. Hiding Known Problems

West Virginia's buyer-beware status does not protect you from fraud claims. If you know about a material defect and fail to disclose it, buyers can sue you after closing. Transparency is both legally required and practically smart—it prevents deals from falling apart during inspection.

3. Refusing All Negotiations After Inspection

Even in as-is sales, some negotiation is normal. Buyers may discover issues you did not know about. Being willing to offer a reasonable credit for unexpected findings keeps deals together. Refusing to budge on anything often causes buyers to walk away.

4. Accepting the First Lowball Offer Out of Desperation

Investor buyers often start with aggressive offers to test your motivation. If priced correctly, your home will attract multiple interested parties. Give the market time to work, and negotiate from a position of knowledge, not fear.

5. Skipping Professional Representation

As-is sales involve complex contract terms, disclosure requirements, and negotiation dynamics. The 1.5–3% you might save by going FSBO often costs more in pricing mistakes, legal exposure, and buyer negotiations gone wrong.

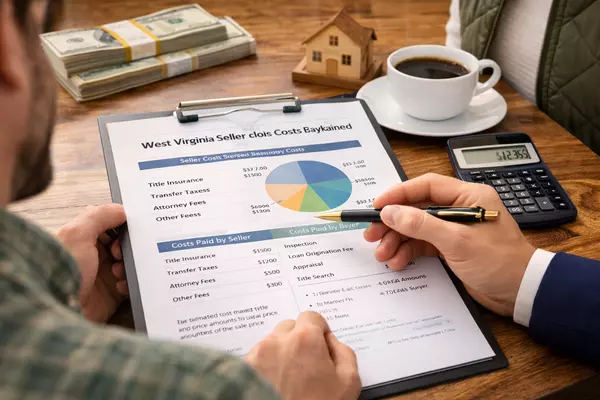

Understanding Closing Costs for As-Is Sales

As-is sellers face the same closing costs as traditional sellers. In West Virginia, typical seller closing costs range from 3.70% to 4% of the sale price, not including real estate commission.

Typical Seller Closing Costs in West Virginia

| Cost Category | Typical Amount |

|---|---|

| Transfer Tax | $1.10 per $500 of sale price (~0.22%) |

| Title Insurance (Owner's Policy) | $500–$1,500 depending on sale price |

| Real Estate Attorney Fees | $750–$1,250 (required in WV) |

| Recording Fees | $50–$150 |

| Prorated Property Taxes | Varies by county and timing |

| Settlement/Escrow Fee | $300–$600 |

| Real Estate Commission | 1.5%–5.65% (negotiable) |

| ESTIMATED TOTAL | 6–10% of sale price |

Understanding these costs upfront helps you calculate your true net proceeds. Use a seller net sheet calculator to estimate what you will actually receive after all costs are deducted.

Planning to Buy After You Sell?

Get a personalized buyer strategy to coordinate your sale and purchase smoothly.

Get Your Buyer StrategyFrequently Asked Questions About Selling As-Is in West Virginia

Can I sell my house as-is without disclosing problems in West Virginia?

No. While West Virginia has limited mandatory disclosure requirements compared to other states, you must still disclose known material defects that affect the property's value or habitability. Federal law also requires lead-based paint disclosure for homes built before 1978. Failing to disclose known issues can result in legal action from buyers after closing.

How much less will I get selling as-is versus making repairs?

As-is homes typically sell for 10–20% below comparable move-in ready homes. However, this discount is often less than the cost of repairs would have been. For example, if your home would sell for $200,000 in good condition but needs $30,000 in repairs, selling as-is at $170,000 nets you the same amount without the hassle and risk of renovation.

Can buyers still get an inspection on an as-is sale?

Yes. Selling as-is does not prevent buyers from ordering inspections. Most buyers will still inspect, and they can walk away if they discover problems they are unwilling to accept. What as-is means is that you are not obligated to make repairs based on inspection findings. Buyers may still request price reductions or credits, but you can decline.

How long does it take to sell a house as-is in West Virginia?

Timeline varies by pricing and condition. Well-priced as-is homes may sell within 30–60 days. Properties with significant issues or overpriced listings may take 90+ days. Cash sales to investors can close in as little as 7–14 days. The current median days on market in West Virginia is approximately 62 days for all home types.

Should I get a pre-listing inspection before selling as-is?

A pre-listing inspection can be valuable because it reveals issues before buyers find them, allows you to price accordingly, demonstrates transparency to buyers, and reduces the chance of surprises that kill deals. The typical cost of $300–$600 is often worth the peace of mind and negotiating advantage it provides.

What if a buyer's loan requires repairs on my as-is home?

FHA and VA loans have minimum property standards. If your home does not meet these standards, financed buyers cannot complete the purchase. You have options: make minimum required repairs, offer a credit at closing, lower your price, or focus marketing on cash buyers. About 29% of West Virginia home sales are cash transactions, providing a significant buyer pool for as-is properties.

Are "We Buy Houses" companies legitimate?

Many are legitimate businesses, but offers vary widely. These companies profit by buying below market value, so expect offers of 50–75% of your home's value. Before accepting, get multiple offers, verify the company's reputation through reviews and the Better Business Bureau, and have a real estate attorney review the contract. Compare their offer to what you might net with a traditional as-is listing.

How do I choose the best real estate agent to sell my as-is home in West Virginia?

Look for agents with specific experience selling distressed or as-is properties. Ask how many as-is sales they have completed, request references from past clients, and inquire about their marketing strategy for investor buyers. Compare fee structures, as some agents like those at Jamil Brothers Realty Group offer competitive 1.5% listing fees while providing full-service representation. An agent with local market knowledge and experience with investor negotiations will typically achieve better results than a generalist.

Do I need a real estate attorney to sell as-is in West Virginia?

West Virginia requires an attorney for closing, so you will need one regardless. Beyond this requirement, having attorney involvement throughout the process is especially valuable for as-is sales to review disclosure documents, ensure contract terms protect you, and address any legal questions about your obligations. Typical attorney fees range from $750 to $1,250 for straightforward closings.

What happens if a buyer backs out after signing an as-is contract?

Contract terms determine what happens next. Most contracts include contingency periods during which buyers can exit without penalty. If a buyer backs out within their contingency period (typically for inspection or financing), they generally receive their earnest money back. If they back out outside contingency periods without valid cause, they may forfeit their earnest money deposit. Your agent and attorney can advise you on specific contract terms and remedies.

Can I sell an inherited house as-is in West Virginia?

Yes, but you must first establish legal authority to sell. If the property went through probate, you will need documentation showing you have the authority to sell. In some cases, you may be able to sell during the probate process with court approval. Inherited homes are excellent candidates for as-is sales because they often have deferred maintenance and out-of-state heirs who cannot manage renovations.

Glossary of Key Terms

As-Is Sale

A real estate transaction where the seller will not make repairs before or after closing. The buyer accepts the property in its current condition.

Caveat Emptor

Latin for "buyer beware." A legal doctrine placing responsibility on buyers to investigate properties before purchase. West Virginia follows this principle.

Material Defect

A significant problem with a property that affects its value, desirability, or ability to be used for its intended purpose. These must be disclosed even in as-is sales.

After-Repair Value (ARV)

The estimated value of a property after all necessary repairs and improvements are completed. Used by investors to determine purchase offers.

Cash Buyer

A buyer who purchases property without mortgage financing. Cash buyers can close faster and do not require properties to meet lender standards.

Inspection Contingency

A contract clause allowing buyers to order an inspection and potentially back out or renegotiate if significant issues are found.

Seller Credit

Money provided by the seller to the buyer at closing, often used to offset repair costs or closing expenses in lieu of making actual repairs.

Transfer Tax

A tax imposed when property ownership transfers from seller to buyer. In West Virginia, this is $1.10 per $500 of sale price.

Earnest Money

A deposit made by buyers to demonstrate serious intent to purchase. Typically 1–3% of sale price, held in escrow until closing.

Mine Subsidence

Ground settling or collapse caused by underground mining activity. Particularly relevant in West Virginia's coal mining regions.

Moving Forward with Your As-Is Sale

Selling your West Virginia home as-is is a legitimate, often smart strategy that can save you time, money, and stress. The key is approaching the process with realistic expectations, proper disclosure, and strategic pricing.

With West Virginia's relatively balanced 2026 market showing steady prices and healthy cash buyer activity, as-is sellers have options. Whether you choose to list with an agent, explore cash offers, or try FSBO, understanding your obligations and opportunities puts you in control of the outcome.

Your next step is getting an accurate sense of your home's value and understanding what you will actually net from the sale. From there, you can make an informed decision about the best path forward for your situation.

Ready to Explore Your Options?

Get a free home valuation and learn how much you could net from selling your as-is home in West Virginia.

This guide is for informational purposes only and does not constitute legal or financial advice. Real estate laws and market conditions vary. Consult with a licensed West Virginia real estate professional and attorney for guidance specific to your situation. Market data reflects conditions as of January 2026 and is subject to change.

Categories

Recent Posts

Let's Connect