Selling a House in Maryland: 8 Steps to a Successful Sale (2026)

Selling a House in Maryland: 8 Simple Steps for a Successful Sale

Whether you're relocating from the Baltimore suburbs, upgrading from your Annapolis starter home, or downsizing in Montgomery County, selling a house in Maryland requires navigating state-specific requirements, competitive market dynamics, and strategic timing decisions that can significantly impact your final sale price.

Maryland's housing market remains resilient heading into 2026, with median home prices hovering around $435,000 and properties spending an average of 46 days on market. However, success in the Free State's diverse real estate landscape—from the waterfront communities of the Eastern Shore to the high-demand neighborhoods surrounding Washington, D.C.—depends on understanding the nuances that make selling here unique.

This comprehensive guide breaks down the entire home-selling process into eight actionable steps, complete with Maryland-specific insights on disclosure requirements, transfer taxes, closing costs, and timing strategies that can help you maximize your proceeds while minimizing stress.

Quick Answer

To sell a house in Maryland successfully, you'll need to hire a qualified agent, price competitively using local market data, prepare your home for showings, complete required disclosures (or file a disclaimer statement), negotiate offers strategically, and budget approximately 8–10% of your sale price for closing costs including the state's 0.5% transfer tax. The best months to list are April through June, when Maryland homes sell fastest and for the highest prices.

Key Takeaways

- Best timing: April through June offers the fastest sales and highest prices in Maryland

- Closing costs: Plan for 8–10% of your sale price, including agent commissions and transfer taxes

- Disclosure choice: Maryland allows sellers to provide either a full disclosure statement OR an "as-is" disclaimer (latent defects must always be disclosed)

- Transfer tax: Maryland charges 0.5% state transfer tax, typically split between buyer and seller

- Market conditions: Median price is approximately $435,000 with homes selling at 99.4% of list price

- Timeline: Expect 30–45 days from accepted offer to closing with traditional financing

Table of Contents

- Find the Right Real Estate Agent

- Decide When to Sell

- Price Your Home Strategically

- Prepare Your Home for Sale

- List and Market Your Property

- Manage Showings and Negotiate Offers

- Navigate Disclosures and Inspections

- Close the Sale

- Maryland Seller Closing Costs Breakdown

- Common Mistakes Maryland Sellers Make

- Alternatives to Traditional Sales

- Frequently Asked Questions

- Maryland Real Estate Glossary

Step 1: Find the Right Real Estate Agent

Your choice of listing agent has an outsized impact on both your final sale price and overall experience. The right agent brings deep local market knowledge, strong negotiation skills, professional marketing resources, and a network of qualified buyers and cooperating agents.

Interview at least two to three agents before signing a listing agreement. Focus on agents who specialize in your specific Maryland market—whether that's the competitive suburbs of Montgomery County, Baltimore's diverse neighborhoods, or the waterfront communities of Anne Arundel County.

What to Look for in a Maryland Listing Agent

Agent Evaluation Checklist

- ☑️ At least 5+ years of experience in your local Maryland market

- ☑️ Strong track record of recent sales in your neighborhood or price range

- ☑️ Professional marketing plan including photography, staging guidance, and online exposure

- ☑️ Clear communication style and availability that matches your needs

- ☑️ Transparent commission structure with room to negotiate

- ☑️ Positive reviews from past clients (check Google, Zillow, and realtor.com)

- ☑️ Knowledge of Maryland-specific requirements like disclosure forms and transfer taxes

Commission structures vary, but the average total commission in Maryland is approximately 5.55%, typically split between the listing and buyer's agents. However, commission rates are negotiable, and some agents offer reduced rates—particularly for higher-priced properties or sellers who are also buying through the same agent.

| Agent Type | Typical Commission | Best For |

|---|---|---|

| Traditional Full-Service Agent | 2.5%–3% | Sellers who want comprehensive support |

| Discount/Low-Commission Agent | 1%–1.5% | Cost-conscious sellers in hot markets |

| Flat Fee MLS Service | $300–$500 flat | Experienced FSBO sellers who want MLS exposure |

Some teams, including those offering a 1.5% listing fee structure, provide full-service representation at a reduced rate—meaning you get professional marketing, skilled negotiation, and complete transaction management while keeping more equity in your pocket.

Step 2: Decide When to Sell

Timing can significantly impact both your sale price and how quickly your home sells. Maryland's housing market follows distinct seasonal patterns, with spring and early summer consistently delivering the strongest results for sellers.

| Month | Avg. Days on Market | Price Premium | Competition Level |

|---|---|---|---|

| April–June | 43–48 days | +5–10% | High |

| July–August | 50–55 days | +3–5% | Moderate-High |

| September–October | 52–58 days | +1–3% | Moderate |

| November–February | 60–70 days | Baseline | Low |

That said, Maryland's market remains relatively active year-round compared to states with harsher winters. The proximity to federal employment centers in Washington, D.C., creates consistent buyer demand from government workers and contractors who relocate throughout the year.

Maryland Selling Season Timeline

Factors Beyond Seasonality

While spring and summer are generally optimal, several other factors should influence your timing decision:

- Mortgage rates: Lower rates expand the buyer pool and increase purchasing power

- Local inventory: Less competition means more attention for your listing

- Personal readiness: Your home's condition, your timeline, and financial situation

- Economic conditions: Maryland's job market stability, particularly in government sectors

Curious What Your Maryland Home Is Worth?

Get a professional market analysis to understand your home's value in today's market—no obligation, no pressure.

Get Your Free Home ValuationStep 3: Price Your Home Strategically

Pricing is arguably the most critical decision you'll make as a seller. Set your price too high, and your home sits on the market, accumulating days that make buyers wonder what's wrong. Price too low, and you leave money on the table.

In Maryland, where approximately 23% of homes sell with price reductions, getting the initial price right is essential. The goal is to generate maximum interest and potentially multiple offers within the first two weeks of listing.

How to Determine Your List Price

Your agent should provide a Comparative Market Analysis (CMA) that examines recent sales of similar properties in your area. Key factors that affect your home's value include:

Price-Affecting Factors

✓ Square footage and lot size

✓ Number of bedrooms/bathrooms

✓ Age and condition of home

✓ Recent updates and renovations

✓ School district quality

✓ Proximity to transit/employment

✓ Neighborhood desirability

✓ Current market conditions

| Pricing Strategy | When to Use | Risk Level |

|---|---|---|

| Market Value Pricing | Balanced market conditions | Low |

| Slightly Below Market | Generating multiple offers/bidding wars | Low-Medium |

| Aspirational Pricing | Unique properties; no urgency | High |

Online home value estimators provide a starting point but often miss crucial factors like recent renovations, neighborhood micro-trends, or condition issues. A professional CMA or in-person evaluation offers far greater accuracy.

Step 4: Prepare Your Home for Sale

First impressions drive buying decisions. A well-prepared home photographs better, shows better, and typically sells faster and for more money than comparable properties that aren't market-ready.

Strategic preparation investments typically return $3–$5 for every dollar spent. However, not every improvement is worth making—focus on high-impact, cost-effective updates rather than major renovations that may not recoup their costs.

Maryland-Specific Preparation Tips

Maryland's humid climate creates some unique preparation considerations:

- Crawl spaces and basements: Check for moisture issues or mold—common in Maryland homes and frequently flagged during inspections

- HVAC systems: Hot, humid summers mean buyers pay close attention to air conditioning condition and efficiency

- Exterior paint and siding: Coastal moisture and seasonal temperature swings can cause premature wear

- Landscaping: Maryland's growing season means lush curb appeal is expected—and noticed when missing

Home Preparation Checklist

Declutter & Depersonalize

- ☐ Remove personal photos and memorabilia

- ☐ Clear countertops and surfaces

- ☐ Organize closets (buyers will look inside)

- ☐ Rent a storage unit if needed

Deep Clean

- ☐ Professional carpet cleaning

- ☐ Window washing (inside and out)

- ☐ Pressure wash exterior and driveway

- ☐ Clean grout and tile in bathrooms/kitchen

Minor Repairs & Updates

- ☐ Fix leaky faucets and running toilets

- ☐ Replace burned-out bulbs and dated fixtures

- ☐ Touch up interior paint (neutral colors)

- ☐ Address any known issues proactively

Curb Appeal

- ☐ Fresh mulch and seasonal flowers

- ☐ Clean or repaint front door

- ☐ Update house numbers and mailbox if worn

- ☐ Ensure outdoor lighting works

| Improvement | Typical Cost | Est. ROI | Priority |

|---|---|---|---|

| Deep cleaning | $200–$500 | 300%+ | Essential |

| Interior paint (neutral) | $1,500–$3,500 | 100–200% | High |

| Landscaping refresh | $500–$1,500 | 150–200% | High |

| Minor kitchen updates | $2,000–$5,000 | 75–125% | Moderate |

| Major renovation | $15,000+ | 50–75% | Case-by-case |

Step 5: List and Market Your Property

Once your home is ready, it's time to go live. Effective marketing maximizes exposure to qualified buyers and creates the momentum needed to generate strong offers quickly.

Essential Marketing Components

Professional Photography: Over 90% of buyers start their search online, making high-quality photos non-negotiable. Professional photographers know how to capture spaces to look their best, using proper lighting, angles, and editing to make your listing stand out.

MLS Listing: The Multiple Listing Service (MLS) is the primary database where agents search for properties. Your listing syndicates from the MLS to major consumer sites like Zillow, Realtor.com, and Redfin.

Compelling Description: Your listing description should highlight key features, recent updates, and neighborhood benefits while avoiding generic language that fails to differentiate your property.

Timing Your Launch: Research suggests listing on Thursday evenings generates the most initial interest, as buyers browsing over the weekend can schedule showings immediately.

See What You'll Actually Net After Selling

Our seller net sheet calculator shows exactly what you'll walk away with after commissions, closing costs, and mortgage payoff.

Calculate Your Net ProceedsStep 6: Manage Showings and Negotiate Offers

Once your listing goes live, you'll need to accommodate showing requests and prepare to evaluate incoming offers. Making your home easily accessible for showings—even on short notice—can be the difference between a quick sale and a prolonged listing.

Showing Best Practices

- Leave during showings so buyers can explore comfortably and speak freely with their agent

- Keep lights on and blinds open to maximize natural light

- Remove pets and their belongings if possible

- Maintain a showing-ready condition daily during active marketing

- Be flexible with scheduling—weekend and evening showings are particularly important

Evaluating and Negotiating Offers

When offers come in, price isn't the only factor to consider. A comprehensive evaluation includes:

| Offer Component | What to Evaluate |

|---|---|

| Purchase Price | Compare to list price and recent comparable sales |

| Earnest Money Deposit | Higher deposits (2–3%+) indicate serious buyers |

| Financing Type | Cash offers close faster; conventional loans are more straightforward than FHA/VA |

| Contingencies | Fewer contingencies = stronger offer; common ones include inspection, financing, and appraisal |

| Closing Timeline | Does the proposed closing date work with your plans? |

| Seller Concessions Requested | Requests for closing cost credits or repairs reduce your net proceeds |

Your agent will help you craft counter-offers when necessary and navigate negotiations to achieve the best possible terms. In Maryland's current market, approximately 30% of homes sell above list price, indicating that well-priced, well-presented homes can still generate competitive bidding.

Step 7: Navigate Disclosures and Inspections

Maryland law requires sellers of residential real estate to provide buyers with specific disclosures about the property's condition. Understanding your obligations helps avoid legal issues and keeps the transaction moving smoothly.

Maryland's Disclosure Options

Maryland is somewhat unique in offering sellers a choice between two approaches:

Option 1: Full Disclosure Statement

Detail all known defects and conditions affecting the property, including structural issues, water damage, environmental hazards, and system functionality.

Most buyers expect this approach from owner-occupants.

Option 2: Disclaimer ("As-Is") Statement

Sell the property "as-is" without representations about its condition—EXCEPT for latent defects, which must still be disclosed.

Often used by investors, estates, or properties needing significant work.

Important: Regardless of which option you choose, Maryland law requires disclosure of any known latent defects—material defects that a buyer wouldn't reasonably discover through visual inspection and that pose health or safety risks. Failure to disclose known issues can result in legal liability.

What Maryland Sellers Must Disclose

The Maryland Residential Property Disclosure and Disclaimer Statement covers numerous categories, including:

• Foundation/structural issues

• Roof condition and leaks

• Water intrusion/moisture

• Plumbing system condition

• Electrical system issues

• HVAC functionality

• Environmental hazards (lead, asbestos, radon, mold)

• Pest infestations (termites, etc.)

• Flood zone status

• HOA information

• Zoning/permit issues

• Carbon monoxide alarm presence

Federal lead-based paint disclosure: If your home was built before 1978, you must also provide the EPA-mandated lead-based paint disclosure and give buyers 10 days to conduct a lead inspection.

The Home Inspection Process

After accepting an offer, the buyer typically has 7–14 days to conduct a home inspection. Inspectors examine the property's major systems and structure, and their findings often lead to repair requests or renegotiation.

Common inspection issues in Maryland homes include:

- Moisture or mold in crawl spaces and attics (Maryland's humidity is a factor)

- HVAC systems approaching end of useful life

- Roof wear and gutter drainage issues

- Electrical panels needing updates

- Grading and drainage problems around foundations

Your agent can help you negotiate reasonable repair requests versus items that are typical maintenance or cosmetic concerns.

Step 8: Close the Sale

Closing (also called "settlement" in Maryland) is the final step where ownership officially transfers to the buyer. In Maryland, closings typically occur 30–45 days after contract ratification for financed purchases, though cash transactions can close in as few as 7–14 days.

What Happens at Closing

Maryland closings involve multiple parties coordinating simultaneously: buyers, sellers, lenders, title companies, and sometimes attorneys. Here's what to expect:

Closing Timeline & Tasks

1–2 Weeks Before Closing

Title company conducts title search; clear any liens or issues

3–5 Days Before Closing

Review settlement statement (closing disclosure); verify all figures

Day Before Closing

Buyer conducts final walkthrough; ensure agreed repairs completed

Closing Day

Sign documents, pay closing costs, transfer keys; funds disbursed to you

Documents You'll Sign

At closing, you'll sign several documents, including the deed transferring ownership, settlement statement confirming all financial details, affidavit of title, 1099-S tax form (for IRS reporting), and any required HOA transfer documents. Your agent and the title company will guide you through each form.

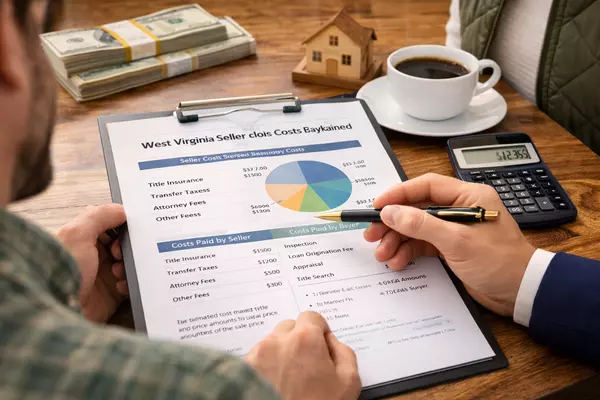

Maryland Seller Closing Costs Breakdown

Understanding your costs upfront helps you accurately project your net proceeds. Maryland seller closing costs typically range from 8% to 10% of the sale price, including agent commissions.

| Cost Category | Typical Amount | Notes |

|---|---|---|

| Real Estate Commissions | 5%–6% | Negotiable; split between agents |

| State Transfer Tax | 0.25%–0.5% | Usually split with buyer; lower if buyer is first-time homebuyer |

| County/Local Transfer Tax | 0.5%–1.5% | Varies by county (Baltimore City: 1.5%, Montgomery: 1%) |

| Title Insurance (Owner's Policy) | 0.5%–1% | Often split or paid by seller in Maryland |

| Recording Fees | $100–$250 | County charges to record deed |

| Prorated Property Taxes | Varies | Your share through closing date (avg. rate: 0.95%) |

| HOA Transfer Fee | $100–$500 | If applicable; varies by community |

| Settlement/Escrow Fee | $500–$1,000 | Often split between buyer and seller |

| Buyer Concessions (if offered) | 0%–3% | Negotiated credits toward buyer's costs |

Estimated Total Closing Costs on a $435,000 Sale

Working with an agent who offers a competitive 1.5% listing fee can significantly reduce your total costs while still providing full-service representation, professional marketing, and expert negotiation support.

Get an Accurate Picture of Your Net Proceeds

Use our seller net sheet tool to see exactly what you'll walk away with after all costs.

Calculate Your Net SheetCommon Mistakes Maryland Sellers Make

Avoiding these common pitfalls can save you time, money, and significant frustration during your home sale:

❌ Mistakes to Avoid

1. Overpricing Your Home

Aspirational pricing leads to extended market time, price reductions, and often a final sale price lower than if priced correctly from the start. Nearly 23% of Maryland homes sell with price drops.

2. Neglecting Curb Appeal and Presentation

Buyers form impressions within seconds of arriving. Overgrown landscaping, cluttered interiors, or deferred maintenance can cost you offers.

3. Failing to Disclose Known Issues

Concealing problems can lead to legal liability and deal collapse. Honesty upfront prevents issues later.

4. Being Unavailable for Showings

Restricting access or requiring excessive notice limits your buyer pool. Flexibility during the marketing period is crucial.

5. Getting Emotionally Attached to Negotiations

Treat your sale as a business transaction. Buyers' repair requests or price negotiations aren't personal attacks.

6. Choosing an Agent Based Solely on Highest Price Estimate

Some agents "buy" listings by suggesting inflated prices. Choose based on track record, marketing plan, and realistic market analysis.

Alternatives to Traditional Sales

While listing with an agent on the open market typically yields the highest sale price, it's not the only option. Depending on your circumstances, alternative selling methods may better suit your needs:

| Method | Pros | Cons | Best For |

|---|---|---|---|

| Traditional Agent Listing | Maximum exposure; professional support; highest prices | Commission costs; 30–60+ day timeline | Most sellers |

| Cash Offer / Direct Sale | Fast closing (7–14 days); no repairs needed; certainty | Lower price (typically 70–85% of market value) | Urgent situations; distressed properties |

| For Sale By Owner (FSBO) | Save listing commission | Limited exposure; legal risks; typically sells for 13% less | Experienced sellers with buyer lined up |

| Flat Fee MLS | MLS exposure; lower cost than full-service | Still need to manage showings, negotiations, paperwork | DIY-comfortable sellers |

Frequently Asked Questions

How long does it take to sell a house in Maryland?

On average, Maryland homes spend approximately 46 days on the market before going under contract. Add another 30–45 days for closing with traditional financing, for a total timeline of roughly 75–90 days from listing to close. Well-priced homes in desirable areas often sell faster, particularly during peak spring and summer months.

What are the total closing costs for sellers in Maryland?

Maryland sellers typically pay 8–10% of the sale price in total closing costs, including agent commissions (5–6%), transfer taxes (1–1.5%), title fees, prorated property taxes, and other settlement charges. Working with a team offering reduced commission rates can significantly lower this total.

Do I need an attorney to sell a house in Maryland?

Maryland does not legally require sellers to hire a real estate attorney. However, many sellers choose to work with one for complex transactions, title issues, or additional peace of mind. If selling FSBO, an attorney can help ensure proper document preparation and legal compliance.

Can I sell my Maryland home "as-is"?

Yes. Maryland allows sellers to use a disclaimer statement selling the property "as-is" without detailed condition representations. However, you must still disclose any known latent defects—material issues that aren't visible and could pose health or safety risks. Buyers may adjust their offers accordingly for as-is sales.

What is Maryland's transfer tax, and who pays it?

Maryland charges a 0.5% state transfer tax on real estate sales (0.25% if the buyer is a first-time Maryland homebuyer). Counties and municipalities add additional transfer taxes ranging from 0% to 1.5%. The transfer tax is typically split between buyer and seller, though this is negotiable.

What is the best month to sell a house in Maryland?

June typically delivers the highest sale prices, while April offers the fastest sales with homes averaging just 43 days on market—about 13 days faster than the annual average. Generally, listing between April and June positions you for both speed and strong pricing.

Will I owe capital gains taxes when I sell my Maryland home?

Most Maryland homeowners won't owe capital gains taxes when selling their primary residence. If you've owned and lived in the home for at least two of the past five years, you can exclude up to $250,000 in gains ($500,000 for married couples filing jointly). Consult a tax professional for your specific situation.

What must I disclose when selling a house in Maryland?

Maryland's disclosure form covers structural condition, roof issues, water intrusion, HVAC and electrical systems, environmental hazards (lead paint, asbestos, radon, mold), pest infestations, flood zone status, and HOA information. Federal law also requires lead paint disclosure for homes built before 1978.

How do I find the best real estate agent in Maryland?

Look for agents with strong track records in your specific area, positive client reviews, professional marketing capabilities, and clear communication. Interview at least 2–3 agents and compare their experience, marketing plans, and commission structures. Teams like Jamil Brothers Realty Group, with over $500 million in total sales and NVAR Lifetime Top Producer recognition, bring deep local expertise and data-driven pricing strategies while offering competitive 1.5% listing fee options that don't compromise service quality.

Should I make repairs before selling my Maryland home?

Focus on high-ROI improvements like deep cleaning, fresh paint, landscaping, and addressing obvious maintenance issues. Major renovations rarely recoup their full cost. Your agent can advise which improvements are worth making based on your home's condition and local buyer expectations.

Maryland Real Estate Glossary

Comparative Market Analysis (CMA): A report prepared by a real estate agent comparing your home to similar recently sold properties to determine appropriate pricing.

Contingency: A condition in a purchase contract that must be met for the sale to proceed—common examples include inspection, financing, and appraisal contingencies.

Earnest Money Deposit (EMD): A good-faith deposit made by the buyer when their offer is accepted, typically held in escrow until closing.

Latent Defect: A material defect not visible during normal inspection that poses health or safety risks—must be disclosed in Maryland regardless of selling approach.

MLS (Multiple Listing Service): The database used by real estate agents to share property listings; provides maximum exposure to potential buyers.

Ratification: The point when all parties have signed the purchase contract and it becomes legally binding.

Settlement (Closing): The final step in a real estate transaction where documents are signed, funds are transferred, and ownership officially changes hands.

Title Insurance: Insurance protecting against claims or legal issues with property ownership; the owner's policy protects the buyer from title defects discovered after purchase.

Transfer Tax: A tax charged by state and local governments when real property changes ownership; in Maryland, the state charges 0.5% (0.25% for first-time buyers) plus varying county/local rates.

Ready to Sell Your Maryland Home?

Get started with a free, no-obligation home valuation and discover how much you could net with our competitive 1.5% listing fee—full service, no compromises.

Buying after selling? Explore our buyer strategy services →

Final Thoughts: Selling Successfully in Maryland

Selling a house in Maryland involves multiple steps, from finding the right agent and pricing strategically to navigating state-specific disclosure requirements and closing costs. While the process may seem complex, breaking it down into these eight clear steps makes it manageable—and with the right preparation and professional guidance, achievable.

The Maryland market continues to offer favorable conditions for sellers, with strong demand, relatively low inventory, and median prices around $435,000. By timing your sale thoughtfully, presenting your home professionally, and working with an experienced local agent, you position yourself to maximize your sale price while minimizing stress.

Whether you're selling in the bustling D.C. suburbs, Baltimore's diverse neighborhoods, or Maryland's charming smaller communities, the fundamentals remain the same: price right, present well, disclose honestly, and negotiate strategically. Follow these eight steps, and you'll be well on your way to a successful sale.

Ready to explore your options? Browse current Maryland listings to see what's selling in your area, or start with a free home valuation to understand your property's market position today.

Categories

Recent Posts

Let's Connect