When Is the Best Time to Sell a House in Maryland? (2026 Data)

When Is the Best Time to Sell a House in Maryland? (2026 Data)

If you're planning to sell your Maryland home in 2026, timing can significantly impact both your final sale price and how quickly you close. While the Old Line State maintains relatively stable demand year-round—thanks to its proximity to Washington D.C., diverse job market, and quality school districts—historical data reveals clear seasonal patterns that savvy sellers can leverage for better results.

This comprehensive guide breaks down Maryland's real estate market month-by-month, examines regional variations from Montgomery County to the Eastern Shore, and provides actionable strategies to help you maximize your home's value regardless of when you choose to list.

Quick Answer

The best time to sell a house in Maryland is late April through early July, when homes sell fastest (averaging 19-28 days on market) and prices peak. May and June consistently deliver the highest median sale prices, while April offers the quickest sales. However, Maryland's strong job market and year-round demand mean well-priced homes sell in every season.

Key Takeaways

- Best months for highest price: May and June deliver median prices 3-5% above annual averages

- Fastest sales: April homes sell in approximately 43 days (total time including closing)—13 days faster than annual average

- Current market conditions: Maryland's median home price is approximately $448,500 with 2.2 months of supply, favoring sellers

- 2026 outlook: Mortgage rates projected between 5.75%-6.3%, potentially bringing more buyers into the market

- Regional variation: Montgomery and Howard counties see year-round demand; rural areas experience more pronounced seasonality

- Thursday listings: Homes listed Thursday evenings generate more weekend showing activity

Table of Contents

- Maryland Market Snapshot: Key Numbers

- Best Months to Sell in Maryland

- Season-by-Season Analysis

- Regional Differences Across Maryland

- 2026 Market Forecast

- What Drives Maryland Home Prices Up or Down

- Selling Costs to Plan For

- Common Timing Mistakes to Avoid

- Alternatives If You Can't Wait for Peak Season

- What This Means for Sellers vs. Buyers

- Frequently Asked Questions

- Glossary of Terms

Maryland Market Snapshot: Key Numbers at a Glance

Before diving into timing strategies, understanding Maryland's current market conditions provides essential context. These figures reflect late 2025 through early 2026 data and indicate a market that continues to favor sellers, though with more balance than the pandemic-era frenzy.

Maryland Real Estate: 2025-2026 Snapshot

$448,500

Median Sale Price

28-46

Days on Market

2.2-3

Months of Supply

100.7%

Sale-to-List Ratio

+4.2%

Year-over-Year Price Change

30%

Homes Sold Above List Price

Sources: Redfin, Realtor.com, Houzeo, Bright MLS (November 2025-January 2026)

These numbers tell an important story: Maryland remains a seller-favorable market. With only 2.2-3 months of housing supply (under 5 months indicates a seller's market) and homes selling at or above asking price, sellers have leverage. However, inventory has increased roughly 18-25% year-over-year, giving buyers more options and creating a more balanced negotiating environment than 2022-2023.

Curious What Your Maryland Home Is Worth Right Now?

Get a complimentary home valuation to see where you stand before timing your sale.

Get Your Free Home ValueBest Months to Sell a House in Maryland

Maryland follows seasonal patterns similar to other Mid-Atlantic states, with spring and early summer representing the most active selling period. However, the state's unique characteristics—including a strong government employment base and proximity to major metropolitan areas—create more year-round stability than many other markets.

If Your Goal Is the Highest Sale Price

Historical data consistently shows that May and June deliver the highest median sale prices in Maryland. During these months, buyer competition peaks as families rush to purchase before the new school year, creating conditions that favor sellers seeking maximum value.

| Month | Relative Price Performance | Price vs. Annual Avg | Seller Advantage |

|---|---|---|---|

| January | Below Average | -2% to -4% | Low |

| February | Below Average | -1% to -3% | Low-Moderate |

| March | Rising | +1% to +2% | Moderate |

| April | Above Average | +2% to +4% | High |

| May ⭐ | Peak | +3% to +5% | Highest |

| June ⭐ | Peak | +3% to +5% | Highest |

| July | Above Average | +2% to +3% | High |

| August | Average to Above | +1% to +2% | Moderate-High |

| September | Average | 0% to +1% | Moderate |

| October | Average | 0% to +1% | Moderate |

| November | Below Average | -1% to -2% | Low-Moderate |

| December | Below Average | -2% to -4% | Low |

*Based on historical Maryland sales data. Actual results vary by location and property type.

If Your Goal Is the Fastest Sale

When speed matters most, April historically delivers the fastest sales in Maryland. During April, homes average approximately 43 days from listing to closing—about 13 days faster than the annual average of 56 days. May and June also offer quick sales, with homes typically spending just 19-28 days on market before going under contract.

Average Days on Market by Season

Keep in mind that "days on market" only measures time from listing to accepted offer. The total selling timeline—including the 35-40 day closing period—means even a spring sale takes approximately 60-80 days from listing to keys-in-hand.

Season-by-Season Analysis for Maryland Sellers

Spring (March - May): Peak Selling Season

Spring dominates Maryland's real estate calendar for good reason. As cherry blossoms bloom around the Tidal Basin and temperatures warm, buyer activity surges across the state. The spring market typically ignites in late February and reaches full intensity by April.

✓ Advantages

- Highest buyer demand of the year

- Homes show best with blooming landscaping

- Families motivated to close before summer

- Multiple offers more common

- Fastest average time to contract

✗ Considerations

- More competing listings on market

- Buyers have more options to compare

- May need pre-listing preparation in winter

- Weather can delay photography/showings

- Higher expectations for curb appeal

For spring success, plan to have your home listing-ready by mid-March. This means completing repairs, decluttering, and staging during the winter months. Professional photography scheduled for a sunny April day can make a significant difference in online presentation.

Summer (June - August): Strong but Slowing

Summer maintains strong momentum from spring, particularly in June and early July. However, activity typically begins tapering by mid-July as vacation schedules interfere with showing availability. Maryland's humid summers can also make house hunting less appealing for some buyers.

That said, summer buyers tend to be serious and motivated. Many are families racing to close before the school year begins, federal employees relocating to the D.C. metro area, or military families with orders to nearby installations like Fort Meade or Aberdeen Proving Ground.

Summer Selling Checklist

- ☐ Ensure A/C is functioning optimally for showings

- ☐ Maintain lawn and landscaping despite heat

- ☐ Schedule showings during cooler morning/evening hours

- ☐ Keep curtains open to showcase natural light

- ☐ Address any humidity-related concerns (musty odors, dehumidifiers)

- ☐ Price competitively—buyer urgency peaks early summer

Fall (September - November): The Second Window

Fall represents Maryland's "second season" for real estate activity. According to recent data, approximately 40% of annual listings occur during August, September, and October. While prices and pace don't match spring peaks, fall offers legitimate opportunities for sellers who missed the earlier window.

Buyers active in fall are often those who lost out in spring bidding wars or who've had changes in life circumstances—job transfers, growing families, or divorces. These buyers tend to be pragmatic and ready to act, though they may negotiate more firmly on price.

Fall Selling Timeline

Early September

List to catch families settling after back-to-school rush

Mid-September to October

Peak fall activity; autumn foliage enhances curb appeal

Early November

Last window before holiday slowdown; serious buyers remain

Late November

Market slows; consider holding until January if possible

Winter (December - February): Lower Competition, Motivated Buyers

Winter is traditionally the slowest season for Maryland real estate, but that doesn't mean sellers should avoid it entirely. While inventory drops significantly—and buyer traffic slows during the holidays—those who are house hunting in December through February tend to be highly motivated.

Winter buyers often include corporate transferees with relocation deadlines, buyers who need to move due to lease expirations, and investors seeking year-end deals. The reduced competition can work in your favor if you price strategically and keep your home show-ready.

Winter Selling Tips for Maryland

- Create a warm, inviting atmosphere during showings (lights on, comfortable temperature)

- Keep walkways and driveways clear of snow and ice

- Use professional photos from warmer months to supplement winter imagery

- Highlight energy efficiency features (insulation, heating system, windows)

- Be flexible with showing times—daylight is limited

- Consider strategic pricing to stand out in a smaller pool

See What You'll Actually Net from Your Maryland Home Sale

Our free seller net sheet calculates your estimated proceeds after all costs—so you can plan your next move with confidence.

Calculate Your Net ProceedsRegional Differences Across Maryland

Maryland's diverse geography—from the D.C. suburbs to the Chesapeake Bay to the Appalachian foothills—creates distinct local markets with varying seasonal patterns. Understanding your specific region helps fine-tune timing strategy.

| Region/County | Median Price Range | Typical DOM | Best Timing Notes |

|---|---|---|---|

| Montgomery County | $600K-$650K | 28-39 days | Strong year-round; federal workforce creates consistent demand |

| Howard County | $550K-$600K | 25-35 days | Top schools drive spring family demand; Columbia popular year-round |

| Anne Arundel County | $480K-$520K | 30-40 days | Waterfront properties peak in spring/summer; Annapolis year-round |

| Baltimore County | $350K-$400K | 30-45 days | Towson/Catonsville competitive; outer areas more seasonal |

| Baltimore City | $220K-$260K | 40-55 days | Varied by neighborhood; trendy areas less seasonal |

| Harford County | $400K-$450K | 17-30 days | Aberdeen/Bel Air strong; military families provide year-round base |

| Prince George's County | $400K-$450K | 35-50 days | D.C. proximity helps; spring peak less pronounced than suburbs |

| Carroll County | $380K-$430K | 40-55 days | More seasonal; spring strongly preferred for rural properties |

| Frederick County | $450K-$500K | 35-45 days | Growing market; spring/summer best for commuter appeal |

| Eastern Shore | $300K-$450K | 45-70 days | Highly seasonal; waterfront peaks late spring through summer |

| Western Maryland | $250K-$350K | 50-80 days | Most seasonal region; avoid winter listings if possible |

The D.C. metro corridor counties (Montgomery, Prince George's, and parts of Anne Arundel and Howard) experience the least seasonality because employment-driven moves happen year-round. Rural and resort-oriented areas like Western Maryland and the Eastern Shore see the most dramatic seasonal swings.

2026 Maryland Market Forecast

Looking ahead to 2026, several factors will influence Maryland's housing market and optimal selling timing. Here's what current projections suggest.

Mortgage Rate Expectations

Mortgage rates are expected to moderate somewhat in 2026, though they'll remain elevated by historical standards. Most forecasts project 30-year fixed rates averaging between 5.75% and 6.3% for the year, with potential dips below 6% possible if inflation continues cooling. Fannie Mae projects rates ending 2026 at approximately 5.9%.

Lower rates could bring more buyers into the market—a one percentage point drop in mortgage rates can expand the pool of qualifying households by approximately 5.5 million nationally. For Maryland sellers, this could mean increased buyer activity, particularly in the spring and early summer of 2026.

2026 Mortgage Rate Projections (30-Year Fixed)

Fannie Mae

5.9%

Year-end 2026

Realtor.com

6.3%

2026 Average

Morgan Stanley

5.75%

Mid-2026

Bankrate

~6%

Range expected

Price and Inventory Projections

Maryland home prices are projected to continue rising modestly in 2026—approximately 2-4% year-over-year—supported by limited inventory and strong employment fundamentals. The state's diversified economy (healthcare, technology, government, education) provides stability even during broader economic uncertainty.

Inventory is expected to continue gradually increasing as the "lock-in effect" weakens. Many homeowners who locked in sub-4% mortgage rates have been reluctant to sell and take on a higher rate, but life events (growing families, job changes, retirements) eventually necessitate moves regardless of rate considerations.

2026 Maryland Market Outlook Summary

- Home prices: Expected to rise 2-4% statewide; some localized variation

- Mortgage rates: Projected to average 5.75%-6.3%, potentially improving affordability

- Inventory: Likely to continue increasing gradually, creating more balanced conditions

- Sales activity: Expected to tick upward as affordability improves

- Market type: Transitioning from strong seller's market toward more balanced

- Best timing implication: Spring 2026 could see heightened activity if rates decline as projected

What Drives Maryland Home Prices Up or Down

Understanding the forces that move Maryland's housing market helps you anticipate whether timing conditions will favor sellers or buyers in a given period.

| Factors That Push Prices UP | Factors That Push Prices DOWN |

|---|---|

|

|

For Maryland specifically, federal government employment trends significantly impact the D.C.-adjacent counties. Policy changes, agency relocations, or budget adjustments can create ripple effects through local housing markets. Similarly, growth in Maryland's biotech and cybersecurity sectors—concentrated in Montgomery County and the I-95 corridor—drives housing demand in specific areas.

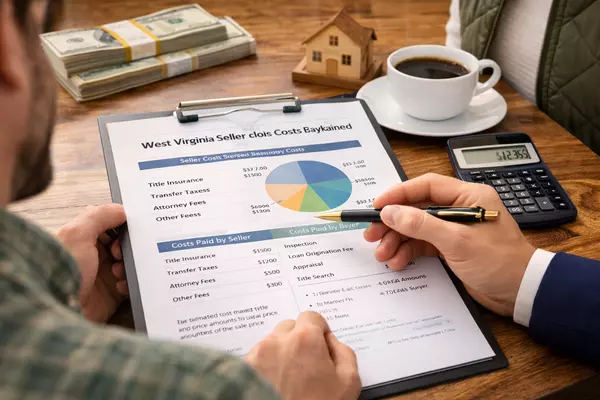

Selling Costs to Plan For

Regardless of when you sell, understanding the full cost picture helps you set realistic expectations and make informed timing decisions. Here's what Maryland sellers typically pay.

| Cost Category | Typical Range | On $450,000 Home |

|---|---|---|

| Listing Agent Commission | 2.5% - 3% | $11,250 - $13,500 |

| Buyer's Agent Concession | 2.5% - 3% | $11,250 - $13,500 |

| Maryland Transfer Tax | 0.5% (seller portion) | $2,250 |

| County Transfer/Recordation Tax | 0.5% - 1.5% | $2,250 - $6,750 |

| Title & Settlement Fees | $800 - $1,500 | $800 - $1,500 |

| Prorated Property Taxes | Varies by date | Varies |

| Home Preparation/Repairs | $1,000 - $5,000+ | $1,000 - $5,000+ |

| Total Estimated Costs | 8% - 10% | $36,000 - $45,000 |

One way to reduce selling costs without sacrificing service quality is to work with agents who offer competitive commission structures. Some full-service brokerages offer listing fees as low as 1.5%, which can save thousands while still providing comprehensive marketing, negotiation, and transaction management.

Keep More of Your Equity When You Sell

Learn how our 1.5% listing fee program provides full-service representation—including professional marketing, skilled negotiation, and complete transaction support—while putting more money in your pocket.

Explore the 1.5% Listing ProgramCommon Timing Mistakes to Avoid

Even sellers who understand seasonal patterns sometimes make timing errors that cost them money or extend their selling timeline. Here are the most common mistakes Maryland sellers make—and how to avoid them.

Timing Mistakes That Cost Sellers Money

1. Waiting for the "Perfect" Market

Some sellers delay listing while waiting for mortgage rates to drop or prices to rise further. Meanwhile, their target home also appreciates, and they may face increased competition when they finally list. If you're ready to move, the best time is usually now.

2. Listing Too Late in Spring

Hitting the market in mid-June means you've missed peak buyer activity in April and May. If spring is your goal, aim to list by late March or early April at the latest.

3. Underestimating Preparation Time

Repairs, decluttering, staging, and professional photography take time. Sellers who want to list in April should begin preparing in January or February—not March.

4. Ignoring Local Market Nuances

Statewide averages don't apply equally everywhere. A waterfront Eastern Shore property follows different patterns than a Bethesda townhome. Work with an agent who understands your specific neighborhood's dynamics.

5. Overpricing to "Test the Market"

Listing high to "see what happens" often backfires. Overpriced homes linger on market, accumulate days-on-market stigma, and eventually sell for less than if they'd been priced correctly from the start—regardless of season.

6. Neglecting Curb Appeal in Off-Peak Seasons

Winter and fall sellers sometimes let exterior maintenance slide. But first impressions matter year-round. Keep walkways clear, add seasonal touches, and ensure exterior lights work for evening showings.

Alternatives If You Can't Wait for Peak Season

Sometimes life doesn't align with optimal market timing. Job relocations, family circumstances, or financial situations may require selling during traditionally slower periods. Here are alternatives to consider.

Strategic Pricing for Off-Season Sales

If you must sell in winter or late fall, pricing becomes even more critical. Consider pricing slightly below comparable spring sales to attract the smaller pool of active buyers. The goal is generating immediate interest rather than letting your home sit and accumulate days on market.

Cash Offer Programs

For sellers who prioritize speed and certainty over maximum price, cash offer options provide an alternative to traditional market timing concerns. These programs allow you to close on your timeline—often within days or weeks—regardless of season. While you'll typically receive less than full market value, the trade-off may be worthwhile for sellers facing time constraints or preferring guaranteed outcomes.

Pre-Listing Preparation During Slow Periods

If you know you'll sell in spring but it's currently winter, use the off-season productively. Complete repairs, update fixtures, paint neutral colors, and address any inspection red flags. When spring arrives, you'll be ready to list immediately rather than scrambling to prepare.

| Option | Speed | Price | Best For |

|---|---|---|---|

| Wait for Peak Season | Months | Highest | Flexible timeline, maximum value priority |

| List Off-Season (Aggressive Price) | 45-75 days | Moderate | Need to move soon, some flexibility |

| Cash Offer / iBuyer | 7-21 days | Below Market | Urgent timeline, certainty priority |

| Rent Property / Delay Sale | Variable | Potential gains | No urgency, willing to be landlord |

What This Means for Sellers vs. Buyers

Current market conditions and timing affect buyers and sellers differently. Here's a side-by-side comparison of what 2026's Maryland market likely means for each group.

| For Sellers | For Buyers |

|---|---|

|

Spring Timing Advantage Listing April-June maximizes buyer competition and sale price potential. Plan preparation now for spring 2026. |

Off-Season Opportunities Fall and winter bring less competition, more negotiating power, and motivated sellers willing to deal. |

|

Market Still Favors You With 2-3 months of supply and homes selling at/above list price, sellers maintain leverage in 2026. |

More Inventory Coming Rising inventory gives you more choices. Take time to find the right home rather than rushing into bidding wars. |

|

Price Appreciation Continues Projected 2-4% appreciation means your equity should grow. No crash expected. |

Rate Relief Possible If rates drop toward 5.75-6% as projected, affordability improves. "Marry the house, date the rate" – refinance later. |

|

Concessions May Increase Buyer requests for closing cost help or repairs are increasing. Budget for potential concessions. |

Negotiating Power Improving Ask for closing cost credits, repair allowances, or home warranties. Sellers are more willing to negotiate. |

Selling and Buying in Maryland?

Coordinate your sale and purchase with a clear buyer strategy. We'll help you navigate timing, bridge gaps, and avoid contingency complications.

Get Your Buyer StrategyFrequently Asked Questions

What is the best month to sell a house in Maryland?

May and June consistently deliver the highest sale prices in Maryland, typically 3-5% above annual averages. For the fastest sales, April edges slightly ahead, with homes averaging about 43 days from listing to closing. If maximizing price is your priority, aim for late April through June. If speed matters most, April or early May is optimal.

Is 2026 a good year to sell a house in Maryland?

Yes, 2026 appears favorable for Maryland sellers. Home prices are projected to appreciate 2-4%, inventory remains below historical norms, and the market continues favoring sellers with homes selling at or above list price. If mortgage rates decline as projected (toward 5.75-6%), buyer activity could increase, potentially creating competitive conditions similar to 2021-2022 in desirable areas.

What is the worst time to sell a house in Maryland?

December through February typically represents the slowest period, with lower buyer traffic, longer days on market, and prices running 2-4% below annual averages. The holiday season particularly impacts activity. However, experienced Maryland agents note there's no truly "bad" time to sell—well-priced homes in good condition attract buyers year-round, especially in the D.C. metro corridor.

How long does it take to sell a house in Maryland?

The total time from listing to closing averages approximately 82 days in Maryland—about 47 days on market to receive an accepted offer, plus 35 days to close. During peak spring months, this timeline can shrink to 60-70 days total. In slower winter months, expect 90-100+ days. These are averages; well-priced homes in desirable areas often sell faster.

Do Maryland homes sell better in spring or fall?

Spring outperforms fall by most metrics. Spring listings typically achieve 3-5% higher prices and sell 10-15 days faster than fall listings. However, fall (particularly September and October) represents the second-strongest selling period, with approximately 40% of annual listings occurring in August through October. Fall buyers tend to be motivated and serious, even if there are fewer of them.

How much are closing costs for sellers in Maryland?

Maryland sellers typically pay 8-10% of the sale price in total selling costs. This includes real estate commissions (5-6%), Maryland state transfer tax (0.5%), county transfer/recordation taxes (0.5-1.5% depending on county), title and settlement fees ($800-$1,500), and miscellaneous costs. On a $450,000 home, expect approximately $36,000-$45,000 in total costs. Working with agents offering competitive commission structures can reduce this significantly.

What day of the week should I list my Maryland home?

Thursday evening is generally optimal. Approximately 21% of homes nationwide list on Thursday, which positions your home to appear fresh in search results heading into the weekend when buyer activity peaks. Listing Thursday after 5 PM captures both end-of-workweek online browsing and Saturday/Sunday showing requests.

Should I wait for mortgage rates to drop before selling?

Not necessarily. While lower rates may bring more buyers to market, they'll also bring more competing sellers and potentially drive up the price of your next home. Mortgage rates are difficult to predict, and waiting for "perfect" conditions often backfires. If you're ready to move and your personal circumstances align, the current market offers solid conditions for sellers. If rates drop after you buy your next home, you can refinance.

How do I choose the best real estate agent in Maryland?

Look for agents with specific experience in your county or neighborhood, a strong recent track record of closed sales, marketing capabilities that match your property type, and clear communication about their strategy. Interview multiple agents, ask for references, and review their sold listings. Consider commission structures—some full-service agents, such as those at Jamil Brothers Realty Group, offer competitive rates while providing comprehensive marketing and negotiation support. Verify credentials, read reviews, and choose someone whose approach aligns with your goals.

Is the Maryland housing market going to crash in 2026?

No credible forecasts predict a Maryland housing market crash in 2026. Home prices remain approximately 80% above pre-pandemic levels with sustained demand, strong employment fundamentals, and constrained inventory supporting price stability. While appreciation may moderate to 2-4% (slower than recent years), this represents normalization rather than decline. Maryland's diversified economy—anchored by government, healthcare, and technology sectors—provides resilience against dramatic corrections.

Does staging matter for selling a house in Maryland?

Yes, particularly for properties competing in higher price ranges or slower-moving markets. Staged homes typically sell faster and often for higher prices. At minimum, decluttering, depersonalizing, and ensuring professional-quality photos are essential. Full staging is most impactful for vacant properties or homes with dated decor. The investment (typically $1,500-$5,000) often returns multiples in faster sales and higher offers.

What repairs should I make before selling my Maryland home?

Focus on repairs that buyers will notice immediately or that inspectors will flag. High-priority items include: functional systems (HVAC, plumbing, electrical), roof condition, water damage or mold remediation (particularly common in Maryland's humid climate, especially in crawl spaces and attics), foundation concerns, and safety issues. Cosmetic updates with strong ROI include fresh neutral paint, updated lighting fixtures, and refinished hardwood floors. Avoid major renovations unless your agent specifically recommends them—most don't return full cost.

Glossary of Terms

Days on Market (DOM)

The number of days a property remains listed for sale before going under contract. Lower DOM generally indicates a seller's market with strong demand.

Months of Supply

How long it would take to sell all current inventory at the current sales pace. Under 5 months indicates a seller's market; over 6 months indicates a buyer's market; 5-6 months is balanced.

Sale-to-List Ratio

The final sale price divided by the original list price, expressed as a percentage. Above 100% means homes are selling above asking; below 100% means sellers are accepting less than asking price.

Lock-In Effect

The phenomenon where homeowners with low mortgage rates (secured during 2020-2021) are reluctant to sell and take on a new mortgage at higher rates, reducing inventory.

Transfer Tax

A tax imposed by state and/or local governments when property ownership changes hands. In Maryland, the state charges 0.5%, and counties impose additional taxes at varying rates.

Seller Concession

Contributions from the seller to help cover buyer expenses, such as closing costs, repair credits, or rate buydowns. Common in buyer-friendly markets or to close deals in negotiations.

Bright MLS

The Multiple Listing Service covering the Mid-Atlantic region, including Maryland. It's the database where real estate agents list properties for sale and access buyer leads.

Median Sale Price

The middle point of all sale prices in a given area and time period. Half of homes sold for more, half sold for less. Unlike averages, medians aren't skewed by very high or very low sales.

Ready to Sell Your Maryland Home?

Whether you're planning for spring or need to move sooner, get a clear picture of your home's value and a personalized selling strategy. Our team serves homeowners throughout Maryland with data-driven pricing and a full-service 1.5% listing fee option.

Looking to buy in Maryland? Browse available homes for sale and start your search.

Categories

Recent Posts

Let's Connect