What’s Next for the Housing Market in 2025?

2025 Housing Market Forecast: What Buyers and Sellers Should Know

If you’ve been watching the housing market, you’ve likely noticed a few changes already this year. But what’s next? From home prices to mortgage rates, here’s what leading experts say is ahead for the rest of 2025 — and what it means for you.

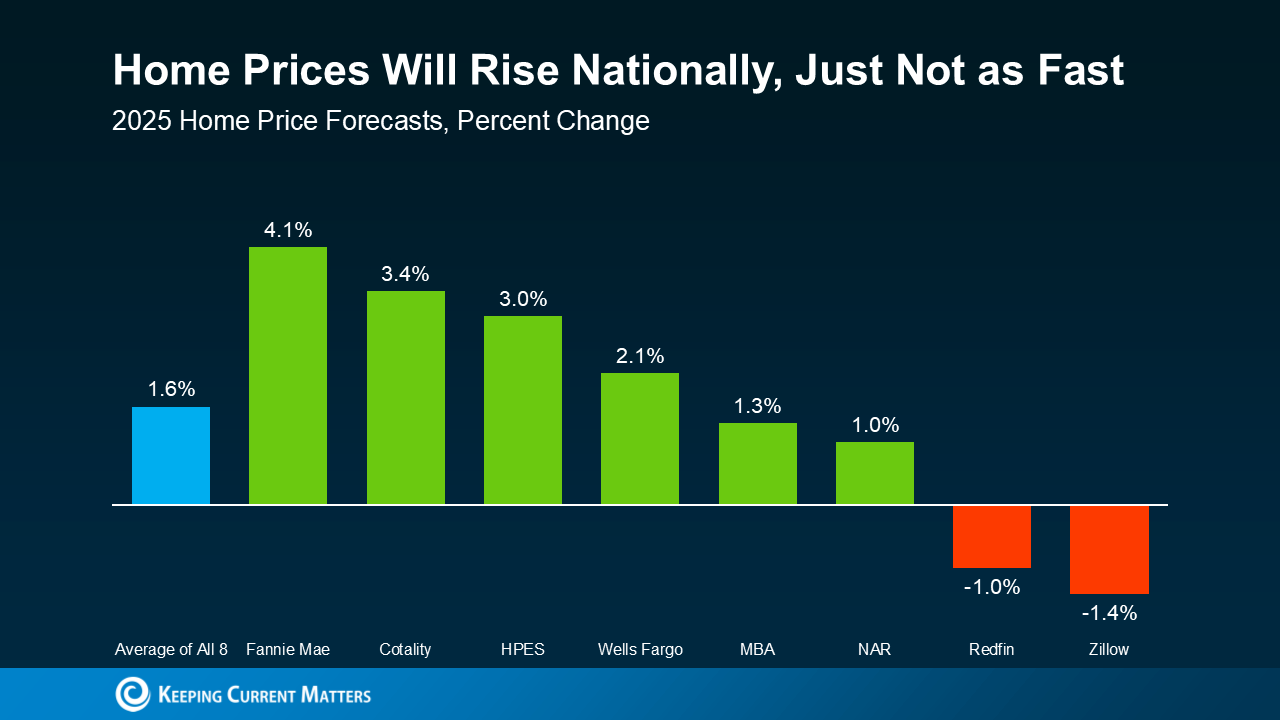

Will Home Prices Fall?

Many buyers are hoping prices will come down — especially with news of slight dips in some areas. But most forecasts suggest home values are still expected to rise nationally, just at a slower pace than previous years.

According to the National Association of Home Builders:

“House price growth slowed . . . partly due to a decline in demand and an increase in supply. Persistent high mortgage rates and increased inventory combined to ease upward pressure on house prices.”

The average forecast from 8 major institutions, including the National Association of Realtors and Mortgage Bankers Association, shows home prices rising by 1.5–2% nationally in 2025.

Some markets may see price dips, but the national average decline is just -3.5% — nowhere near the 20% drop seen during the 2008 crash. In fact, FHFA data shows national prices are still up 55% compared to just five years ago.

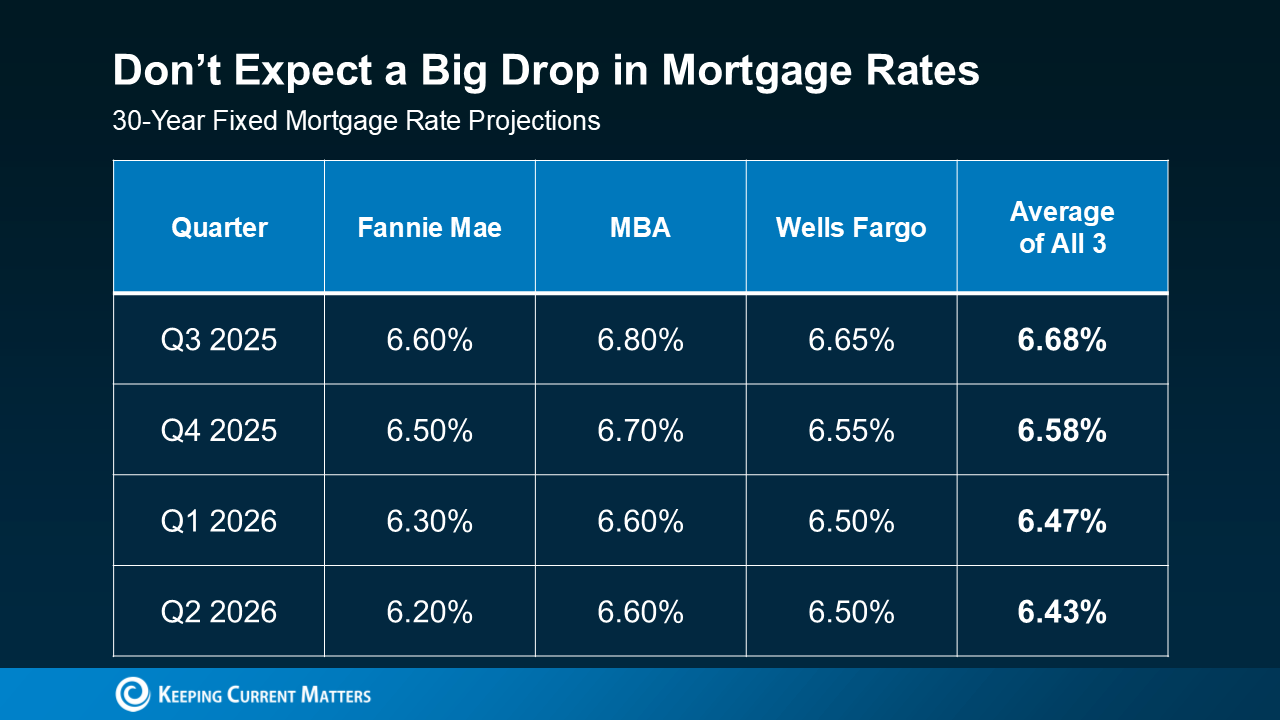

Will Mortgage Rates Come Down?

Many buyers are waiting for interest rates to drop. But most experts say major declines aren’t likely in 2025. As reported by Yahoo Finance:

“If you’re looking for a substantial interest rate drop in 2025, you’ll likely be left waiting. The latest news from the Federal Reserve and other key economic data point toward steady mortgage rates on par with what we see today.”

Forecasts from Fannie Mae and others suggest mortgage rates will hover in the mid-6% range through the end of 2025.

What This Means for Buyers and Sellers

Whether you’re looking to buy, sell, or invest, this is a year to focus on strategy. Prices are still moving upward, albeit slowly, and rates are likely to remain steady. That makes working with a local expert more important than ever.

Buyers: Don’t wait for the perfect rate — instead, find the right home and negotiate wisely.

Sellers: Price strategically and prep your home well. The right listing still moves fast in many Northern Virginia markets.

-- by KCM Crew

Let’s Make a Smart Move in 2025

At The Jamil Brothers Realty Group, we specialize in helping clients navigate evolving market conditions with confidence. Whether you’re entering the market or planning your next step, we’re here to guide you every step of the way.

Your best move starts with the right insight — let’s connect today.

FAQs

Is 2025 a good time to buy a home in Northern Virginia?

Yes — while mortgage rates remain elevated, home prices are rising more slowly and buyers have more leverage than during past peak markets.

Will mortgage rates drop significantly later this year?

Most experts expect rates to stay in the mid-6% range through the end of 2025, with no major drops projected.

Should I wait to sell until prices rise more?

Not necessarily. If you’re ready to move, today’s market still offers solid demand and less competition if your home is priced and presented well.

Recent Posts

Let's Connect