Harvard Warns: Soaring Home Prices and Rates Are Pushing Buyers Out

A recent housing report from Harvard’s Joint Center for Housing Studies is bringing national attention to something many of us here in Northern Virginia already know. Buying a home has become harder than ever. But while the numbers may seem discouraging, understanding what’s happening can help buyers and homeowners navigate the road ahead with clarity and confidence.

What the Harvard Report Reveals

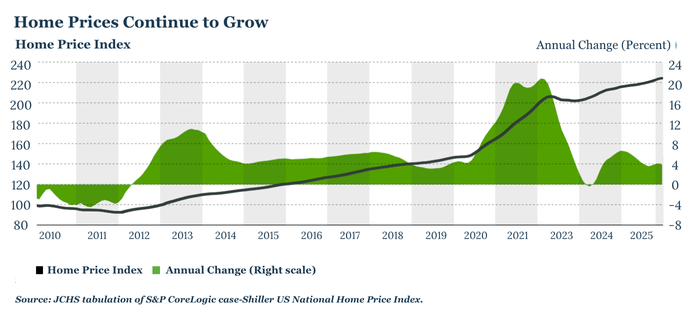

The 2025 State of the Nation’s Housing Report highlights a nationwide trend. Homeownership rates fell to 65.6% in 2024, which is the first decline in nearly a decade. That drop comes as home prices have surged by nearly 60% since 2019, and mortgage rates continue to hover around 6.8%. For many Americans, the dream of owning a home feels more distant than ever.

The report also points to a growing affordability crisis. Many families are struggling to qualify for a mortgage or find homes within reach of their income level. These pressures are creating ripple effects across the housing market, especially for younger buyers.

Younger Buyers Facing New Challenges

The impact is especially sharp for millennials and Gen Z, who are just beginning their homeownership journeys. According to recent findings , first-time home purchases have dropped to their lowest levels since the 1980s. Today, a buyer often needs to earn over $126,000 annually to afford a typical home. That is a big leap compared to just a few years ago.

Despite these challenges, the desire to own a home is still strong. Many young buyers are simply adjusting their expectations and timing. With the right support and strategy, that first home is still possible.

How the Trend Is Playing Out in Northern Virginia

These national trends are very real here at home. In Northern Virginia, the median sales price is now around $664,000. Homes in communities like Fairfax, Loudoun, and Arlington continue to attract strong interest, but rising prices and limited supply have made it harder for buyers to find the right fit. According to Virginia REALTORS® , closed sales are down by about 4 percent year over year.

Even so, our region remains one of the most desirable in the country. With top-rated schools, major employers, and quick access to Washington, D.C., the long-term value of Northern Virginia real estate remains strong. Homes that are priced well and move-in ready continue to see solid buyer activity.

There Are Still Opportunities Ahead

While today’s market can feel overwhelming, it is not without opportunity. Buyers who are patient, strategic, and informed can still find great options. Sellers, especially those with updated or well-located homes, are in a strong position to connect with motivated buyers.

The key is to have a clear understanding of your timing, your financing, and your goals.

At Jamil Brothers Realty Group, we are committed to helping everyone make smart decisions with confidence. Whether you are just starting to explore, ready to buy, or thinking of selling, our team is here to guide you every step of the way.

If you're wondering how this evolving market affects your plans, let’s connect. We’re here to answer your questions and help you move forward, at your pace, and with a plan that fits your goals.

Recent Posts

Let's Connect