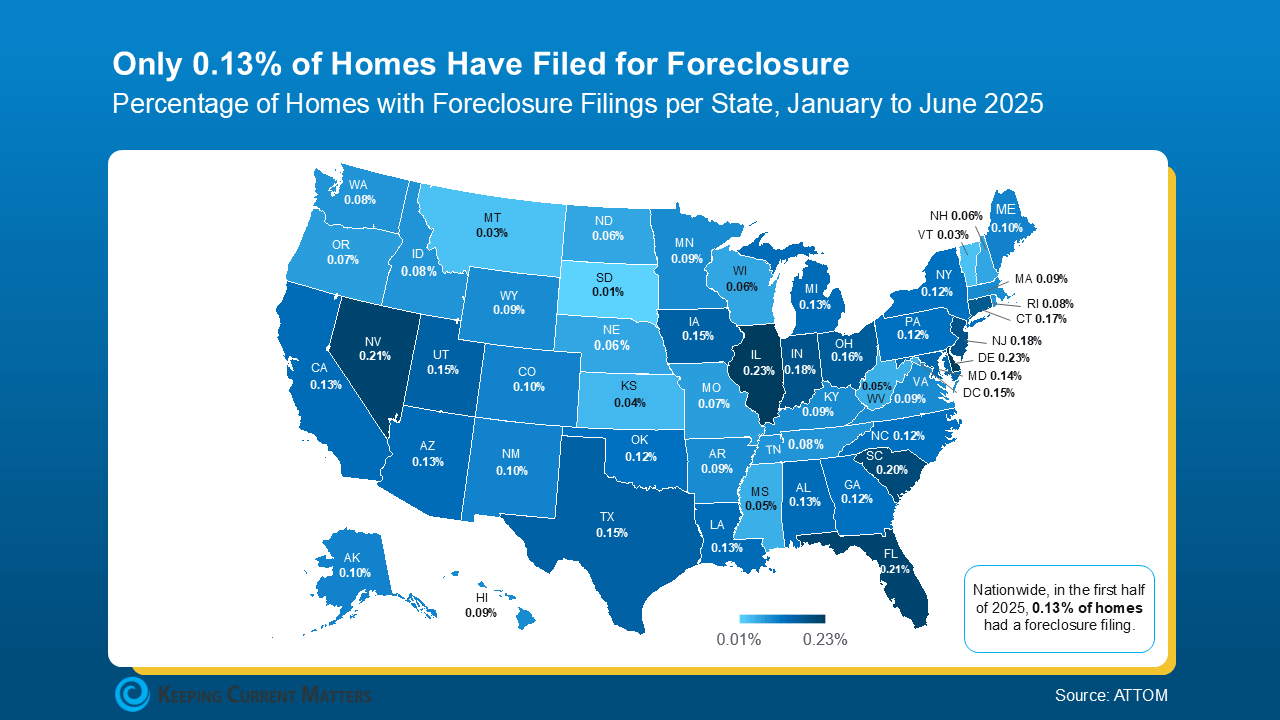

The U.S. Foreclosure Map You Need To See

Are Foreclosures Surging? Here’s What the Data Really Says

Foreclosure headlines are making noise again — and they’re designed to stir up fear to get you to read them. But what the data shows tells a very different story than the headlines suggest. Let’s take a look at the bigger picture.

Foreclosure Activity Is Still Historically Low

Yes, foreclosure starts are up 7% in the first half of 2025. But zoom out and you’ll see that’s still nowhere near crisis levels.

According to ATTOM, just 0.13% of homes had a foreclosure filing in that time — that’s 1 in every 758 homes. In contrast, back in 2010 during the housing crash, it was 1 in every 45 homes.

Today’s Market Is Much Healthier Than in 2008

Before the 2008 crash, risky lending practices and underwater mortgages left many homeowners with no choice but to walk away. But today’s market is very different. Lending standards are tighter, and homeowners have built up near record levels of equity.

“. . . a significant factor contributing to today’s comparatively low levels of foreclosure activity is that homeowners — including those in foreclosure — possess an unprecedented amount of home equity.”

— Rick Sharga, Founder of CJ Patrick Company

If a homeowner faces hardship today, chances are they can sell their home and use their equity — rather than lose it through foreclosure.

Facing Difficulty? You Have Options

No one wants to see a homeowner struggle. If you’re in a tough spot, speak with your mortgage provider early. They may offer solutions like loan modifications, repayment plans, or forbearance.

The Bottom Line

While headlines may sound alarming, the data tells a calmer story. Foreclosure activity remains far below historical highs and isn’t signaling a crash.

If you want to understand how this impacts your local market or your home’s value, connect with a local expert. They’ll help you separate fact from fear with real data.

Need Real Market Insight? Let’s Talk

At The Jamil Brothers Realty Group, we help clients navigate changing market conditions with clarity and confidence. Whether you’re buying, selling, or staying put — we’re here to support your best move.

Let’s connect and talk about your options today.

FAQs

Are foreclosures spiking in 2025?

No. While there’s been a small increase, filings remain far below the levels seen during the housing crash of 2008–2010.

What’s causing the recent rise in foreclosure activity?

Economic strain in certain areas and the natural end of pandemic-related protections have led to slight increases, but overall risk remains low thanks to strong equity levels and better lending standards.

What should I do if I’m worried about foreclosure?

Speak with your lender as early as possible. Many options — including repayment plans or loan modification — are available before foreclosure becomes necessary.

-- by KCM Crew

Categories

Recent Posts

Let's Connect