How Much Does It Cost to Sell a House in Fairfax, Fairfax County?

If you’re a homeowner in Fairfax, Fairfax County Virginia, you’re probably asking: “How much will it cost to sell my house?” Selling involves several line items — realtor commissions, state and local transfer taxes, title and escrow fees, prorated property taxes, and optional costs like staging or pre-list inspections. When you add them up, the total can meaningfully reduce the net proceeds from your sale. This guide walks through each cost, explains why Fairfax-specific factors matter, and shows where sellers commonly save — including the 1.5% full-service listing option.

We’ll be practical and specific: you’ll get Virginia-specific closing cost details, examples using local median prices, market context for Fairfax, and clear steps you can take to keep more of your equity when you sell in Fairfax, Fairfax County Virginia.

Get a Free Fairfax Net-Proceeds Estimate

Use our calculator to compare traditional commission models vs. our 1.5% full-service listing program. We’ll factor in local taxes, title fees, and your home's estimated repairs so you see the real numbers — not surprises.

Free Net Proceeds CalculatorTypical Costs When Selling a Home in Fairfax

Here are the categories every Fairfax seller should budget for and what each covers:

- Realtor commissions: Traditionally ~5.5%–6% total (split between listing and buyer agents). This is usually the largest single charge and is often negotiable.

- Seller closing costs (Virginia): commonly ~3%–3.5% of sale price and include grantor’s (transfer) tax, recording/recordation fees, title and settlement charges, and prorated property taxes. Specific line items vary by county. :contentReference[oaicite:0]{index=0}

- Pre-sale prep & repairs: variable — from minor touch-ups to larger repairs. Many sellers spend a few hundred to several thousand dollars here depending on condition and staging choices.

- Buyer concessions or incentives: in slower/competitive markets, sellers sometimes pay part of the buyer’s closing costs (often 1%–2%) to keep deals moving.

- Other possible fees: HOA payoff/transfer fees, pre-inspection or home warranty costs, and moving expenses.

When you add the big items up, many Fairfax sellers see 8%–10% of sale price in combined commissions and typical closing costs before optional prep costs. That’s why commission structure matters — keep that equity where it belongs: with you.

Virginia-Specific Closing Costs Explained

Virginia has a few seller-side fees that show up on nearly every closing statement; understanding them prevents surprises:

- Grantor’s (transfer) tax: paid by the seller in many transactions — structure varies (examples: $0.50 per $500; additional local/region charges can apply in Northern Virginia). Check with your title company for exact county rates. :contentReference[oaicite:1]{index=1}

- Recordation tax / fees: charged to record the deed or mortgage release; amounts vary by county and by the number of documents recorded. Typical guidance lists a small percentage or flat fees. :contentReference[oaicite:2]{index=2}

- Title insurance & settlement fees: costs for title search and insurance (protects buyer and lender) and escrow/settlement services. Seller often pays certain title-related charges — ask your title company for a line-by-line estimate. :contentReference[oaicite:3]{index=3}

- Prorated property taxes & HOA/condo payoffs: taxes are prorated to the closing date; HOA transfer fees or outstanding dues may be seller responsibilities depending on the HOA rules.

Rule of thumb resources and regional calculators estimate seller closing costs at roughly 3%–3.5% of the sale price in Virginia — but the exact amount depends on your county, loan payoffs, and any negotiated concessions. :contentReference[oaicite:4]{index=4}

Why Fairfax County Numbers Matter

Fairfax County has among the highest average sale prices in the region — recent data shows average/median sale prices that are well above national averages. Because commissions and many closing charges are percent-based, higher sale prices mean much larger absolute dollars paid in fees. For example, county reports show average sales prices and data points reflecting mid-2025 figures (average sales price and days on market compiled by county and Bright MLS). :contentReference[oaicite:5]{index=5}

Market trend notes for Fairfax, Fairfax County Virginia:

- Median/average prices: Fairfax County’s reported averages in 2025 are higher than many nearby counties — which magnifies commission-dollar amounts. (See county economic indicator summary.) :contentReference[oaicite:6]{index=6}

- Inventory & demand: 2025 showed periods of higher active listings than 2024 in some months, which can shift leverage to buyers in those pockets — meaning sellers may need to price carefully or offer incentives in certain neighborhoods. :contentReference[oaicite:7]{index=7}

- Days on market: Fairfax averages often fall in the ~2–4 week range for well-marketed homes but vary by price band and condition. Local county reports track days on market monthly. :contentReference[oaicite:8]{index=8}

Commission: How It’s Split & Why It’s Negotiable

The combined commission (e.g., 6%) is typically split between the listing (seller’s) agent and the buyer’s agent. Historically that split is roughly half/half, but there’s no law mandating percentages — commissions are negotiated between seller and listing broker. Modern brokerages use technology and scaled marketing to lower overhead, enabling full-service options at lower listing-side fees.

Commission Basics

- Seller usually pays total commission at closing

- Traditional split often ~3% listing / ~3% buyer’s agent

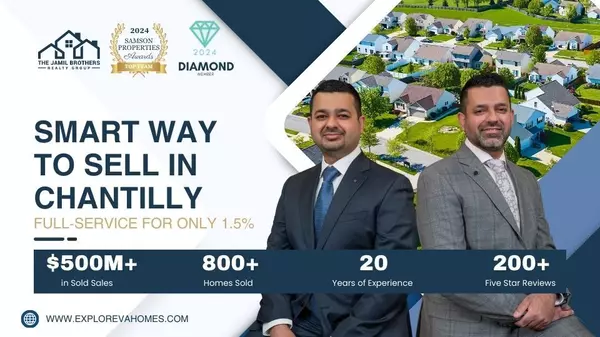

- Listing-side fees can be negotiated (1.5% programs are real and full-service)

- Buyer agent compensation matters for agent incentives and buyer exposure

Commission Comparison — Real Example (Fairfax)

Using a representative Fairfax price point (median/average range observed in 2025), here’s how commission models affect your net proceeds.

| Model | Total Rate | Fee on $715,000 | Savings vs. 6% |

|---|---|---|---|

| Traditional | 6% | $42,900 | $0 |

| Negotiated | 5% | $35,750 | $7,150 |

| 1.5% Listing + 2.5% Buyer | 4% | $28,600 | $14,300 |

*Estimates assume buyer-side fee and other closing costs are comparable; consult your net-proceeds estimate for exact figures.

Optional & Often-Overlooked Costs

Beyond commissions and core closing fees, plan for these extras:

- Pre-list inspection: $300–$600 — helps you identify repair items and avoid slow negotiations later.

- Staging & professional photos: $500–$5,000 depending on staging level — staged homes statistically sell faster and often at higher prices.

- Repairs negotiated after inspection: buyer inspection requests can lead to seller credits or repairs costing thousands.

- Home warranty for buyer: $300–$700 if offered as an incentive in certain listings.

- HOA transfer or payoff fees: can be hundreds to a few thousand depending on the association.

Small line items add up. Budgeting a cushion (often 1%–2% of sales price) for these optional items helps avoid surprises and keeps your closing smooth.

How to Keep More of Your Equity — Tactics That Work

- Negotiate listing-side fee: ask agents to itemize services and show how a 1.5% listing fee still delivers the same (or better) marketing ROI.

- Ask for a seller net sheet: demand a line-by-line estimate showing commission, title charges, transfer taxes, and expected net proceeds.

- Pre-list repairs where ROI is high: small investments in paint, curb appeal, or minor repairs can produce higher offers and shorter market time.

- Time your listing: know local seasonality — spring and early summer often bring higher buyer activity in Northern Virginia, but check local data before deciding.

- Compare multiple offers carefully: don’t focus only on purchase price; consider inspection contingencies, closing timeline, and buyer financing strength.

Frequently Asked Questions

Ready to See the Numbers for Your Fairfax Home?

We’ll prepare a custom net-proceeds estimate showing traditional commissions vs. our 1.5% full-service listing program, plus local closing fees and suggested pre-list items. No obligation — just clear numbers.

📞 Call Now: (703) 375-9583

Schedule Free Consultation

Categories

Recent Posts

Let's Connect